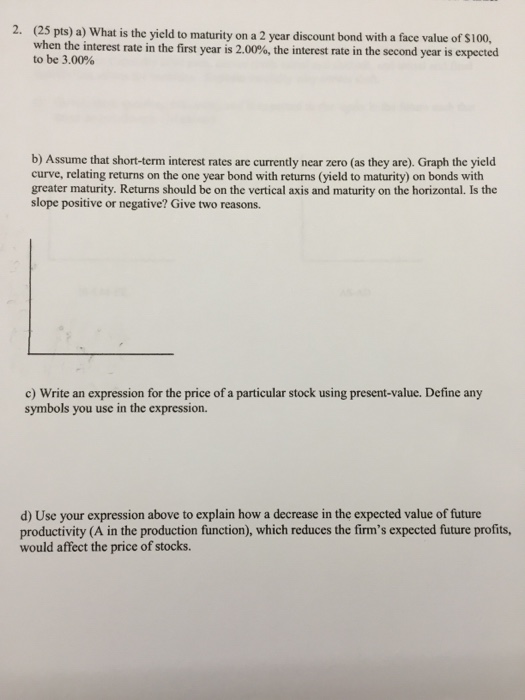

Question: What is the yield lo maturity on a 2 year discount bond with a face value of $100, when the interest rate in the first

What is the yield lo maturity on a 2 year discount bond with a face value of $100, when the interest rate in the first year is 2.00%, the interest rate in the second year is expected to be 3.00% b) Assume that short-term interest rates arc currently near zero (as they are). Graph the yield curve, relating returns on the one year bond with returns (yield to maturity) on bonds with greater maturity. Returns should be on the vertical axis and maturity on the horizontal. Is the slope positive or negative? Give two reasons. c) Write an expression for the price of a particular stock using present-value. Define any symbols you use in the expression. d) Use your expression above to explain how a decrease in the expected value of future productivity (A in the production function), which reduces the firm's expected future profits, would affect the price of stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts