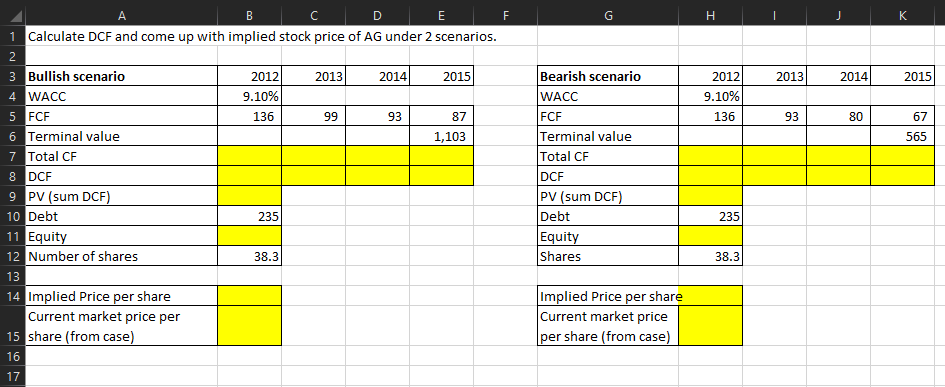

Question: Fill in the missing blanks and solve. Please show excel formulas for answers. B F G H K 2013 2014 2015 2012 9.10% 136 93

Fill in the missing blanks and solve. Please show excel formulas for answers.

B F G H K 2013 2014 2015 2012 9.10% 136 93 93 80 67 565 D E 1 Calculate DCF and come up with implied stock price of AG under 2 scenarios. 2 3 Bullish scenario 2012 2013 2014 2015 4 WACC 9.10% 5 FCF 136 99 87 6 Terminal value 1,103 7 Total CF 8 DCF 9 PV (sum DCF) 10 Debt 235 11 Equity 12 Number of shares 38.3 13 14 Implied Price per share Current market price per 15 share (from case) 16 17 Bearish scenario WACC FCF Terminal value Total CF DCF PV (sum DCF) Debt Equity Shares 235 38.3 Implied Price per share Current market price per share (from case)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts