Question: Fill the table BELOW The senior management has allocated you 400,000,000 units of each currency as the initial balance for your speculation strategy if you

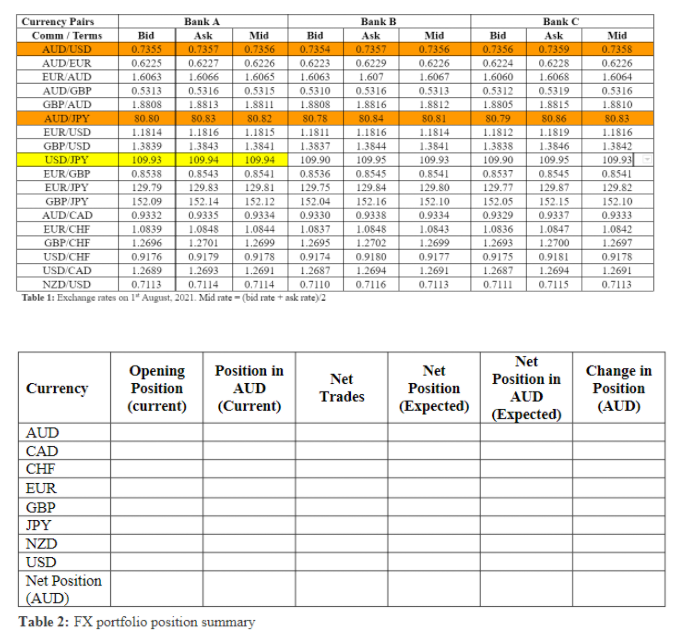

Fill the table BELOW The senior management has allocated you 400,000,000 units of each currency as the initial balance for your speculation strategy if you are speculating on AUD, GBP, CAD, EUR, NZD, CHF or USD and 25,000,000,000 units if you are speculating on JPY. For instance, if you are speculating on AUD/EUR and AUD/GBP and decided to short the EUR and long GBP, then you have been allocated 400,000,000 EURs and 400,000,000 AUDs for this purpose. AUD/GBP currency pair (short aud, long gbp) USD/JPY currency pair (long usd, short jpy)

Currency Pairs Bank A Comm/Terms Bid Ask Mid Bid AUD/USD 0.7355 0.7357 0.7356 0.7354 AUD EUR 0.6225 0.6227 0.6226 0.6223 EUR AUD 1.6063 1.6066 1.6063 1.6063 AUD GBP 0.5313 0.5316 0.5315 0.5310 GBP AUD 1.8808 1.8813 1.8811 1.8808 AUD JPY 80.80 80.83 80.82 80.78 EUR USD 1.1814 1.1816 1.1815 1.1811 GBP/USD 1.3839 1.3843 1.3841 1.3837 USD/JPY 109.93 109.94 109.94 109.90 EUR/GBP 0.8538 0.8543 0.8541 0.8536 EUR JPY 129.79 129.83 129.81 129.75 GBP/JPY 152.09 152.14 152.12 152.04 AUD CAD 0.9332 0.9335 0.9334 0.9330 EUR/CHF 1.0839 1.0848 1.0844 1.0837 GBP/CHF 1.2696 1.2701 1.2699 1.2693 USD CHF 0.9176 0.9179 0.9178 0.9174 USD/CAD 1.2689 1.2693 1.2691 1.2687 NZD/USD 0.7113 0.7114 0.7114 0.7110 Table 1: Exchange rates on 19 August, 2021. Mid rate - (bid rate + ask rate) 2 Bank B Ask 0.7357 0.6229 1.607 0.5316 1.8816 80.84 1.1816 1.3844 109.95 0.8545 129.84 152.16 0.9338 1.0848 1.2702 0.9180 1.2694 0.7116 Mid 0.7356 0.6226 1.6067 0.5313 1.8812 80.81 1.1814 1.3841 109.93 0.8541 129.80 152.10 0.9334 1.0843 1.2699 0.9177 1.2691 0.7113 Bid 0.7356 0.6224 1.6060 0.5312 1.8805 80.79 1.1812 1.3838 109.90 0.8537 129.77 152.05 0.9329 1.0836 1.2693 0.9175 1.2687 0.7111 Bank C Ask 0.7359 0.6228 1.6068 0.5319 1.8815 80.86 1.1819 1.3846 109.95 0.8545 129.87 152.15 0.9337 1.0847 1.2700 0.9181 1.2694 0.7115 Mid 0.7358 0.6226 1.6064 0.5316 1.8810 80.83 1.1816 1.3842 109.93 0.8541 129.82 152.10 0.9333 1.0842 1.2697 0.9178 1.2691 0.7113 Net Trades Net Position (Expected) Net Position in AUD (Expected) Change in Position (AUD) Opening Position in Currency Position AUD (current) (Current) AUD CAD CHF EUR GBP JPY NZD USD Net Position (AUD) Table 2: FX portfolio position summary Currency Pairs Bank A Comm/Terms Bid Ask Mid Bid AUD/USD 0.7355 0.7357 0.7356 0.7354 AUD EUR 0.6225 0.6227 0.6226 0.6223 EUR AUD 1.6063 1.6066 1.6063 1.6063 AUD GBP 0.5313 0.5316 0.5315 0.5310 GBP AUD 1.8808 1.8813 1.8811 1.8808 AUD JPY 80.80 80.83 80.82 80.78 EUR USD 1.1814 1.1816 1.1815 1.1811 GBP/USD 1.3839 1.3843 1.3841 1.3837 USD/JPY 109.93 109.94 109.94 109.90 EUR/GBP 0.8538 0.8543 0.8541 0.8536 EUR JPY 129.79 129.83 129.81 129.75 GBP/JPY 152.09 152.14 152.12 152.04 AUD CAD 0.9332 0.9335 0.9334 0.9330 EUR/CHF 1.0839 1.0848 1.0844 1.0837 GBP/CHF 1.2696 1.2701 1.2699 1.2693 USD CHF 0.9176 0.9179 0.9178 0.9174 USD/CAD 1.2689 1.2693 1.2691 1.2687 NZD/USD 0.7113 0.7114 0.7114 0.7110 Table 1: Exchange rates on 19 August, 2021. Mid rate - (bid rate + ask rate) 2 Bank B Ask 0.7357 0.6229 1.607 0.5316 1.8816 80.84 1.1816 1.3844 109.95 0.8545 129.84 152.16 0.9338 1.0848 1.2702 0.9180 1.2694 0.7116 Mid 0.7356 0.6226 1.6067 0.5313 1.8812 80.81 1.1814 1.3841 109.93 0.8541 129.80 152.10 0.9334 1.0843 1.2699 0.9177 1.2691 0.7113 Bid 0.7356 0.6224 1.6060 0.5312 1.8805 80.79 1.1812 1.3838 109.90 0.8537 129.77 152.05 0.9329 1.0836 1.2693 0.9175 1.2687 0.7111 Bank C Ask 0.7359 0.6228 1.6068 0.5319 1.8815 80.86 1.1819 1.3846 109.95 0.8545 129.87 152.15 0.9337 1.0847 1.2700 0.9181 1.2694 0.7115 Mid 0.7358 0.6226 1.6064 0.5316 1.8810 80.83 1.1816 1.3842 109.93 0.8541 129.82 152.10 0.9333 1.0842 1.2697 0.9178 1.2691 0.7113 Net Trades Net Position (Expected) Net Position in AUD (Expected) Change in Position (AUD) Opening Position in Currency Position AUD (current) (Current) AUD CAD CHF EUR GBP JPY NZD USD Net Position (AUD) Table 2: FX portfolio position summary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts