Question: Fimm A and B carry no debt, have the same current earnings before interest and taxes (EBIT = Rs. 1,000 lakhs), have the same tax

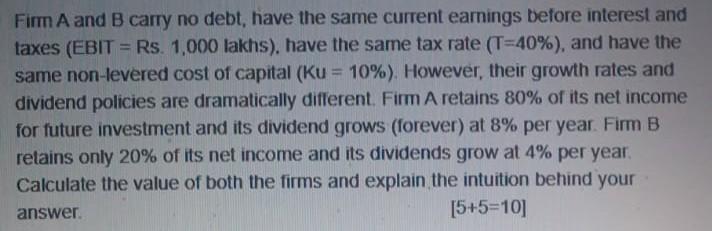

Fimm A and B carry no debt, have the same current earnings before interest and taxes (EBIT = Rs. 1,000 lakhs), have the same tax rate (T=40%), and have the same non-levered cost of capital (Ku = 10%). However, their growth rates and dividend policies are dramatically different. Firm A retains 80% of its net income for future investment and its dividend grows (forever) at 8% per year Firm B retains only 20% of its net income and its dividends grow at 4% per year Calculate the value of both the firms and explain the intuition behind your answer. [5+5=10]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock