Question: FIN 3 3 2 Integrative Case Study You have been asked to evaluate proposal to expand one of X Co's existing plants and make recommendations,

FIN

Integrative Case Study

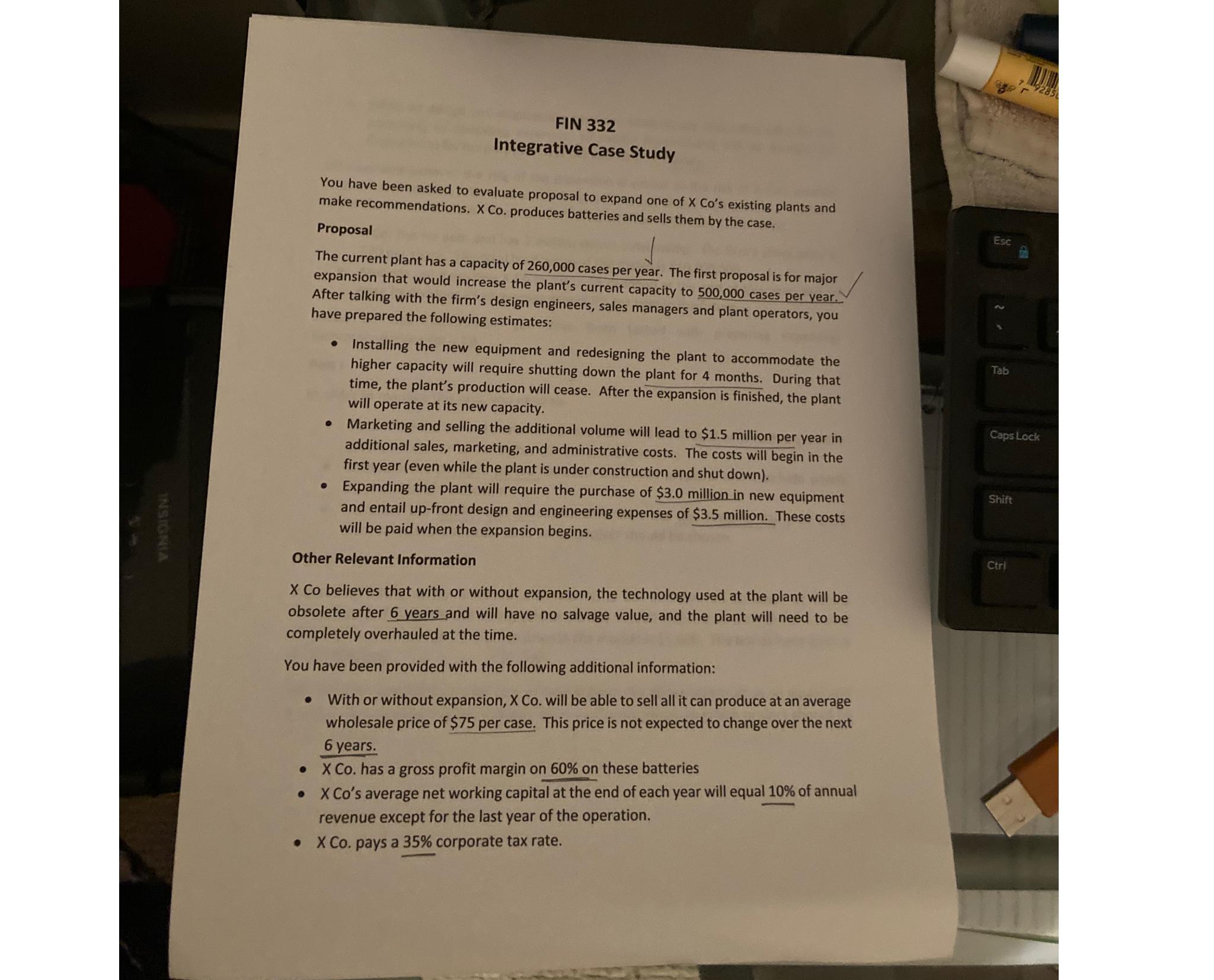

You have been asked to evaluate proposal to expand one of X Co's existing plants and make recommendations, produces batteries and sells them by the case.

Proposal

The current plant has a capacity of cases per year. The first proposal is for major expansion that would increase the plant's current capacity to cases per year. After talking with the firm's design engineers, sales managers and plant operators, you have prepared the following estimates:

Installing the new equipment and redesigning the plant to accommodate the higher capacity will require shutting down the plant for months. During that time, the plant's production will cease. After the expansion is finished, the plant will operate at its new capacity.

Marketing and selling the additional volume will lead to $ million per year in additional sales, marketing, and administrative costs. The costs will begin in the first year even while the plant is under construction and shut down

Expanding the plant will require the purchase of $ million in new equipment and entail upfront design and engineering expenses of $ million. These costs will be paid when the expansion begins.

Other Relevant Information

Co believes that with or without expansion, the technology used at the plant will be obsolete after years and will have no salvage value, and the plant will need to be completely overhauled at the time.

You have been provided with the following additional information:

With or without expansion, xCo. will be able to sell all it can produce at an average wholesale price of $ per case. This price is not expected to change over the next years.

XCo. has a gross profit margin on on these batteries

XCo's average net working capital at the end of each year will equal of annual revenue except for the last year of the operation.

X Co pays a corporate tax rate.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock