Question: FIN 5 3 0 9 Homework 6 Solution - Fall 2 0 2 1 ( 4 0 points ) RStudio application Consider the daily gold

FIN Homework Solution Fall

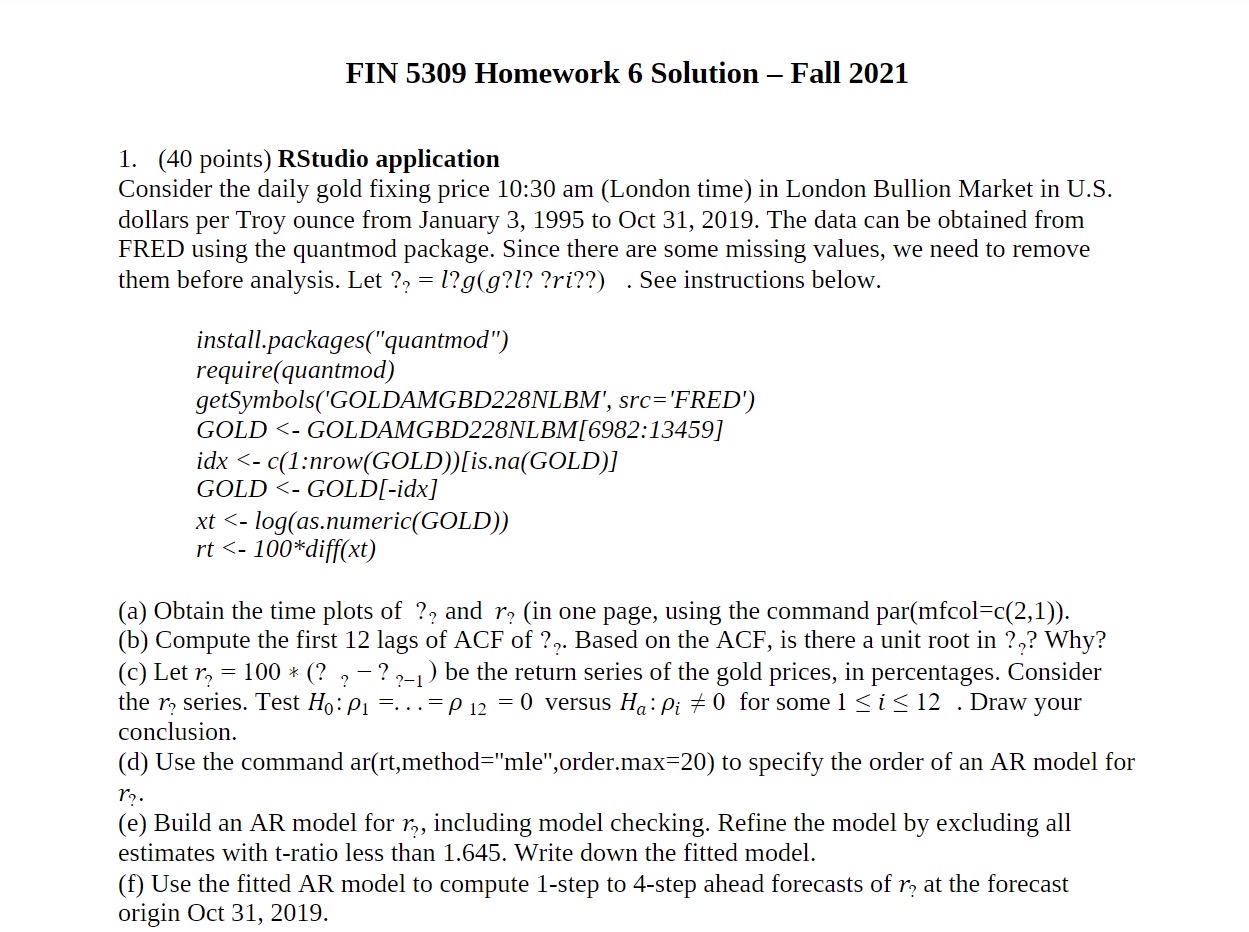

points RStudio application

Consider the daily gold fixing price : am London time in London Bullion Market in US dollars per Troy ounce from January to Oct The data can be obtained from FRED using the quantmod package. Since there are some missing values, we need to remove them before analysis. Let ri See instructions below.

install.packagesquantmod

requirequantmod

getSymbolsGOLDAMGBDNLBM src'FRED'

GOLD GOLDAMGBDNLBM:

idx c:nrowGOLD

isnaGOLD

GOLD GOLDidx

asnumericGOLD

a Obtain the time plots of and in one page, using the command par

b Compute the first lags of ACF of Based on the ACF, is there a unit root in Why?

c Let be the return series of the gold prices, in percentages. Consider the series. Test :dots versus : for some Draw your conclusion.

d Use the command arrtmethod"mle",order.max to specify the order of an AR model for

e Build an AR model for including model checking. Refine the model by excluding all estimates with tratio less than Write down the fitted model.

f Use the fitted AR model to compute step to step ahead forecasts of at the forecast origin Oct

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock