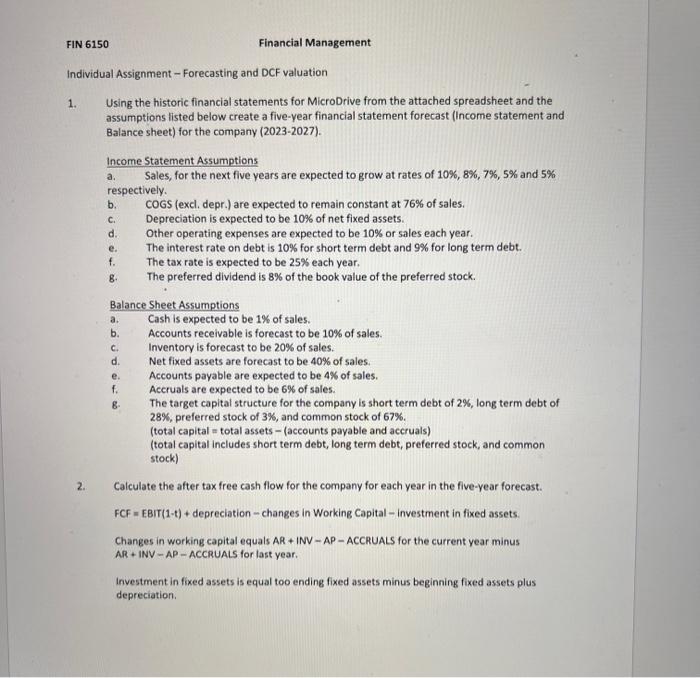

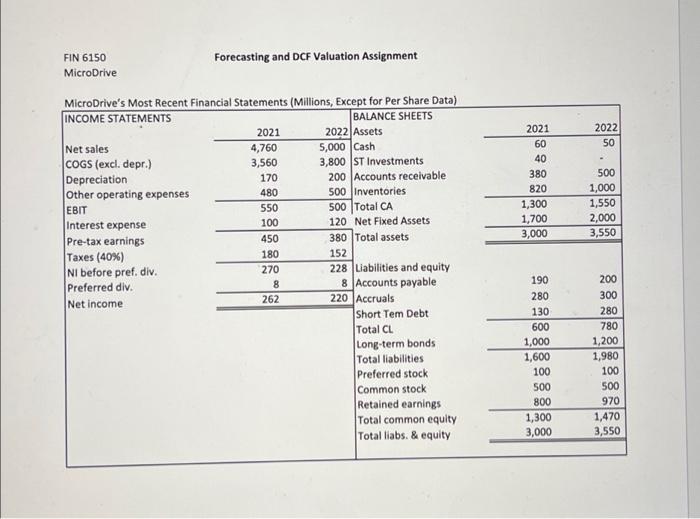

Question: FIN 6150 Individual Assignment - Forecasting and DCF valuation Using the historic financial statements for MicroDrive from the attached spreadsheet and the assumptions listed below

Balance Sheet Assumptions a. Cash is expected to be 1% of sales. b. Accounts receivable is forecast to be 10% of sales. c. Inventory is forecast to be 20% of sales. d. Net fixed assets are forecast to be 40% of sales. e. Accounts payable are expected to be 4% of sales. f. Accruals are expected to be 6% of sales. g. The target capital structure for the company is short term debt of 2%, long term debt of 28%, preferred stock of 3%, and common stock of 67%. (total capital = total assets - (accounts payable and accruals) (total capital includes short term debt, long term debt, preferred stock, and common stock) Calculate the after tax free cash flow for the company for each year in the five-year forecast. FCF= EBIT (1t)+ depreciation - changes in Working Capital - investment in fixed assets. Changes in working capital equals AR+INVAP - ACCRUALS for the current year minus AR+ INV - AP - ACCRUALS for last year. Investment in fixed assets is equal too ending fixed assets minus beginning fixed assets plus depreciation. Forecasting and DCF Valuation Assignment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts