Question: Finance question (CAPM and expected returns) a. Given the following holding-period returns, , compute the average returns and the standard deviations for the Zemin Corporation

Finance question

Finance question

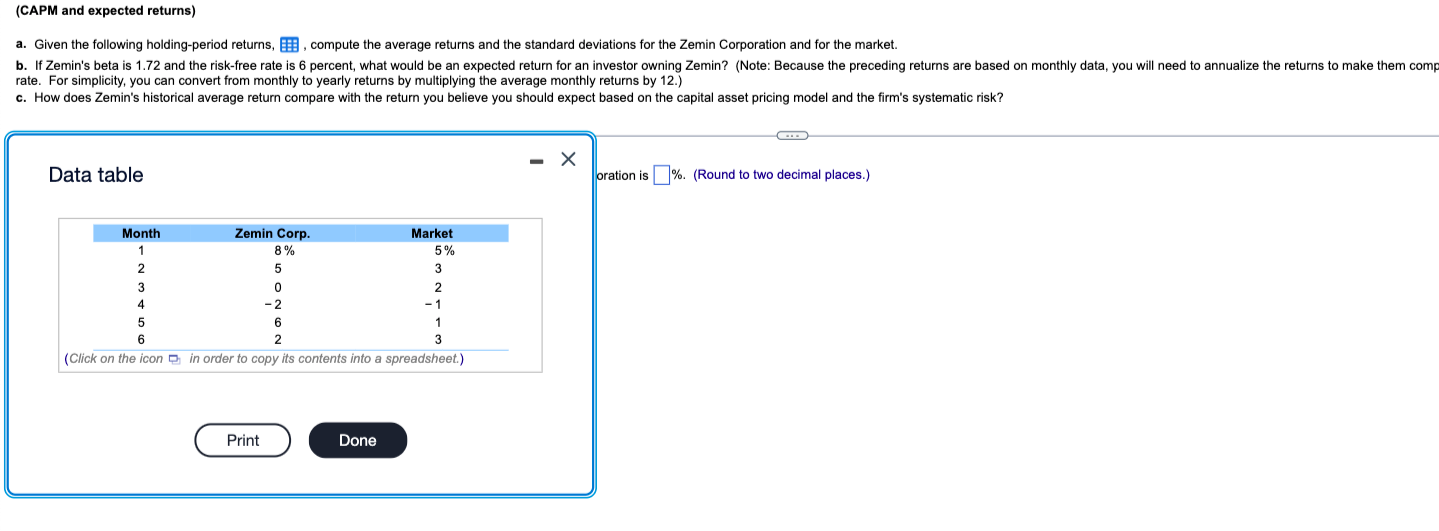

(CAPM and expected returns) a. Given the following holding-period returns, , compute the average returns and the standard deviations for the Zemin Corporation and for the market. b. If Zemin's beta is 1.72 and the risk-free rate is 6 percent, what would be an expected return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comp rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk? CO Data table oration is %. (Round to two decimal places.) Month Zemin Corp. Market 1 8 % 5% 2 5 3 3 0 2 4 -2 -1 5 6 1 6 2 3 (Click on the icon in order to copy its contents into a spreadsheet.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts