Question: Financial Analysis02 (New Buffettology) Question help for homework and test practice! Show work Security Analysis (New Buffettology) Problem 1: Apply Warren Buffett's analysis, as described

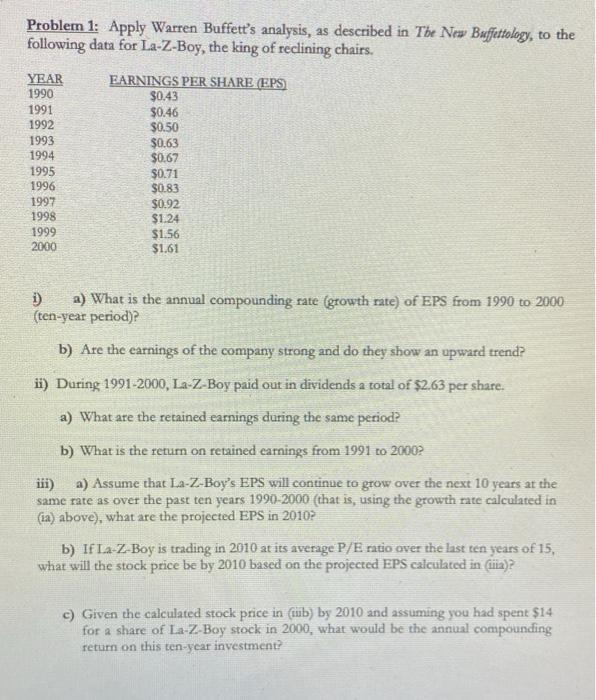

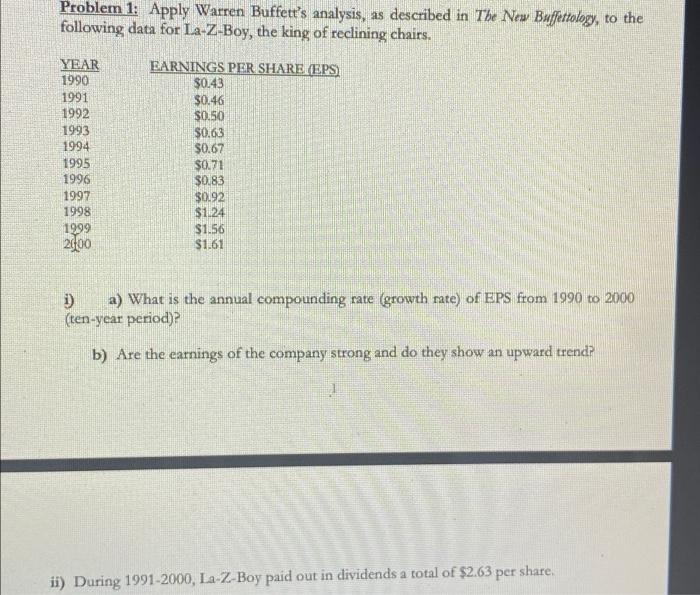

Problem 1: Apply Warren Buffett's analysis, as described in The New Buffettology, to the following data for La-Z-Boy, the king of reclining chairs. i) a) What is the annual compounding rate (growth rate) of EPS from 1990 to 2000 (ten-year period)? b) Are the earnings of the company strong and do they show an upward trend? ii) During 1991-2000, La-Z-Boy paid out in dividends a total of $2.63 per share. a) What are the retained earnings during the same period? b) What is the return on retained earnings from 1991 to 2000 ? iii) a) Assume that La-Z-Boy's EPS will continue to grow over the next 10 years at the same rate as over the past ten years 19902000 (that is, using the growth rate calculated in (ia) above), what are the projected EPS in 2010? b) If L a-Z-Boy is trading in 2010 at its average P/E natio over the last ten years of 15 , what will the stock price be by 2010 based on the projected EPS calculated in (iiia)? c) Given the calculated stock price in (iib) by 2010 and assuming you had spent $14 for a share of La-Z-Boy stock in 2000 , what would be the annual compounding return on this ten-year investment? Problem 1: Apply Warren Buffett's analysis, as described in The New Buffettology, to the following data for La-Z-Boy, the king of reclining chairs. i) a) What is the annual compounding rate (growth rate) of EPS from 1990 to 2000 (ten-year period)? b) Are the earnings of the company strong and do they show an upward trend? ii) During 1991-2000, La-Z-Boy paid out in dividends a total of $2.63 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts