Question: You are buying an investment property. It is November 15th. You get the following information from the seller: He says he gets rent of

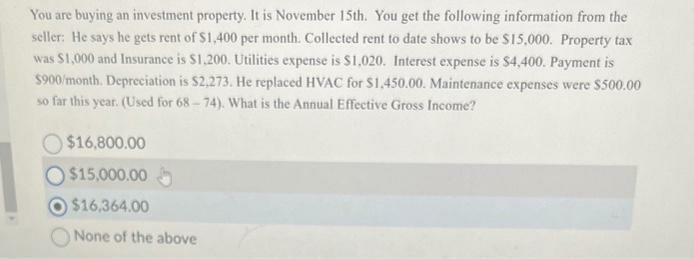

You are buying an investment property. It is November 15th. You get the following information from the seller: He says he gets rent of $1,400 per month. Collected rent to date shows to be $15,000. Property tax was $1,000 and Insurance is $1,200. Utilities expense is $1,020. Interest expense is $4,400. Payment is $900/month. Depreciation is $2,273. He replaced HVAC for $1,450.00. Maintenance expenses were $500.00 so far this year. (Used for 68-74). What is the Annual Effective Gross Income? $16,800.00 $15,000.00 $16,364.00 None of the above

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

The answer is c 16364 explain using calculations 1400 ren... View full answer

Get step-by-step solutions from verified subject matter experts