Question: Financial Math Problem: Binomial Tree Pricing Model Problem 3 (Required, 25 marks) The current price of a company stock is $100. The price movement in

Financial Math Problem: Binomial Tree Pricing Model

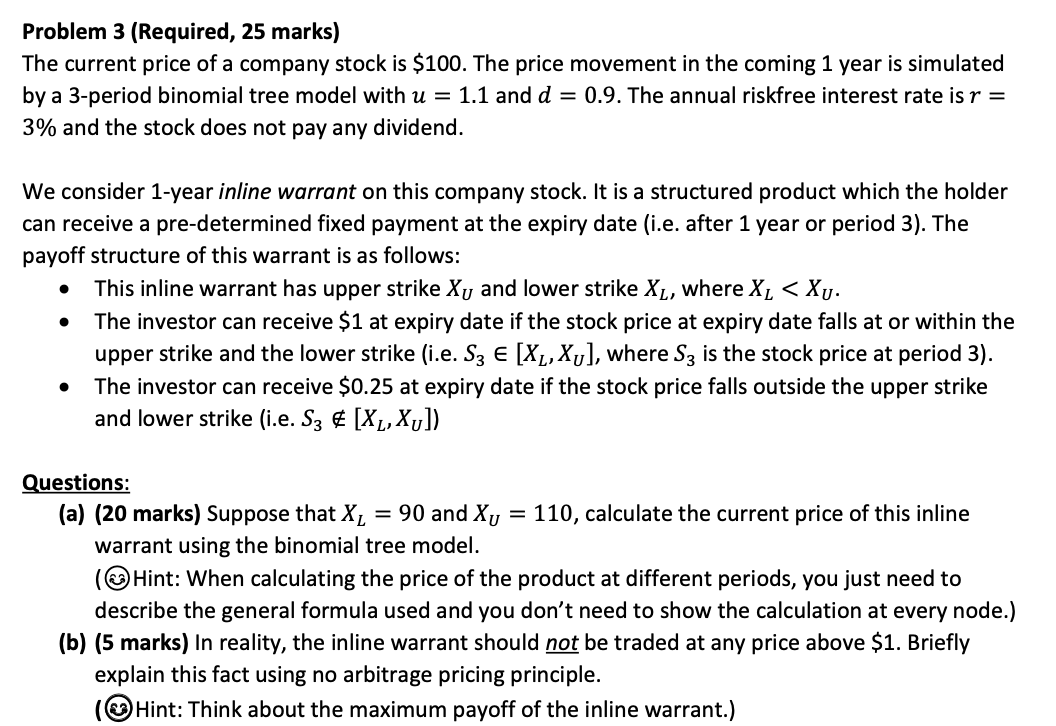

Problem 3 (Required, 25 marks) The current price of a company stock is $100. The price movement in the coming 1 year is simulated by a 3-period binomial tree model with u = 1.1 and d = 0.9. The annual riskfree interest rate is r = 3% and the stock does not pay any dividend. We consider 1-year inline warrant on this company stock. It is a structured product which the holder can receive a pre-determined fixed payment at the expiry date (i.e. after 1 year or period 3). The payoff structure of this warrant is as follows: This inline warrant has upper strike Xy and lower strike XL, where XL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts