Question: Financial Math Problem Problem 2 (Required, 25 marks) We consider a 9-month European put options on a non-dividend paying asset. The strike price of the

Financial Math Problem

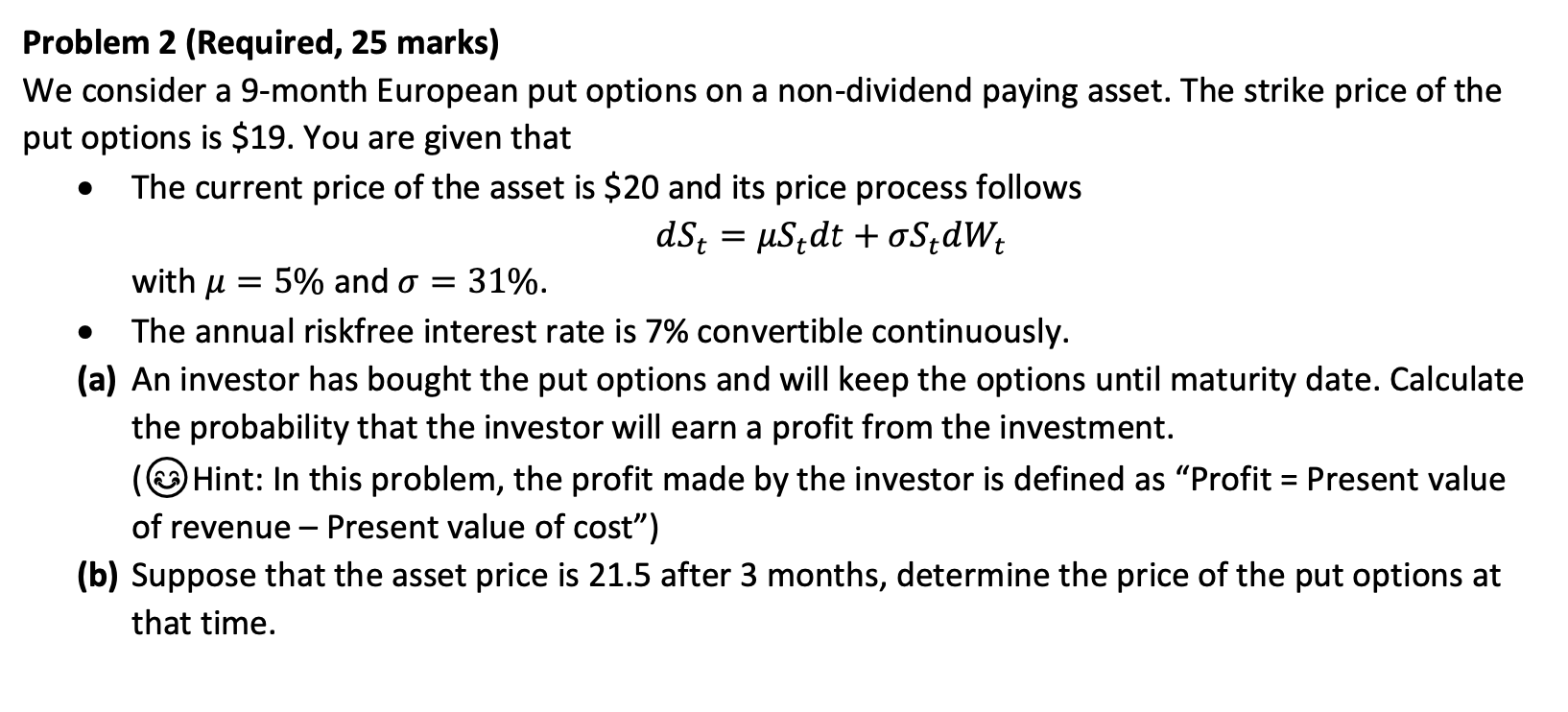

Problem 2 (Required, 25 marks) We consider a 9-month European put options on a non-dividend paying asset. The strike price of the put options is $19. You are given that The current price of the asset is $20 and its price process follows dSt = usedt + OSdW with u = 5% and o = 31%. The annual riskfree interest rate is 7% convertible continuously. (a) An investor has bought the put options and will keep the options until maturity date. Calculate the probability that the investor will earn a profit from the investment. (Hint: In this problem, the profit made by the investor is defined as Profit = Present value of revenue Present value of cost) (b) Suppose that the asset price is 21.5 after 3 months, determine the price of the put options at that time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts