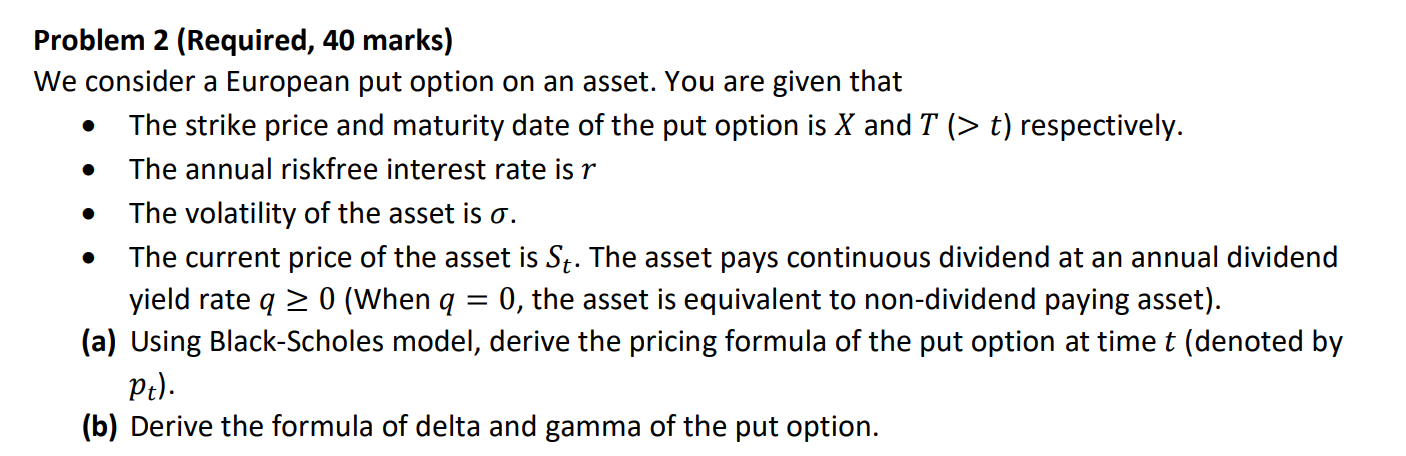

Question: Problem 2 (Required, 40 marks) We consider a European put option on an asset. You are given that - The strike price and maturity date

Problem 2 (Required, 40 marks) We consider a European put option on an asset. You are given that - The strike price and maturity date of the put option is X and T(>t) respectively. - The annual riskfree interest rate is r - The volatility of the asset is . - The current price of the asset is St. The asset pays continuous dividend at an annual dividend yield rate q0 (When q=0, the asset is equivalent to non-dividend paying asset). (a) Using Black-Scholes model, derive the pricing formula of the put option at time t (denoted by pt) (b) Derive the formula of delta and gamma of the put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts