Question: Financial statement analysis Liabilities Current liabilities Accounts payable Accrued liabilities and other Deferred revenue Resale value guarantees Customer deposits Current portion of debt and finance

Financial statement analysis

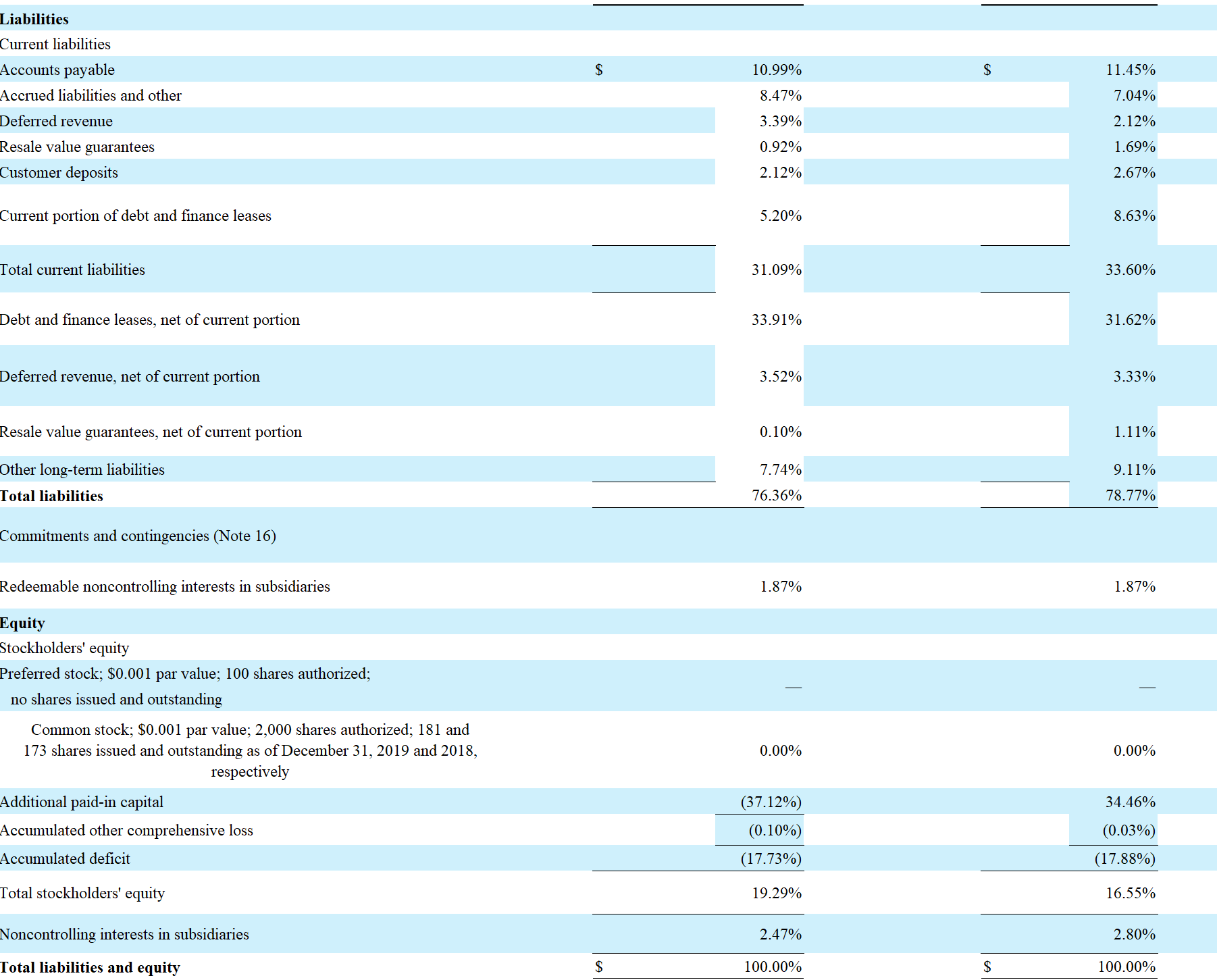

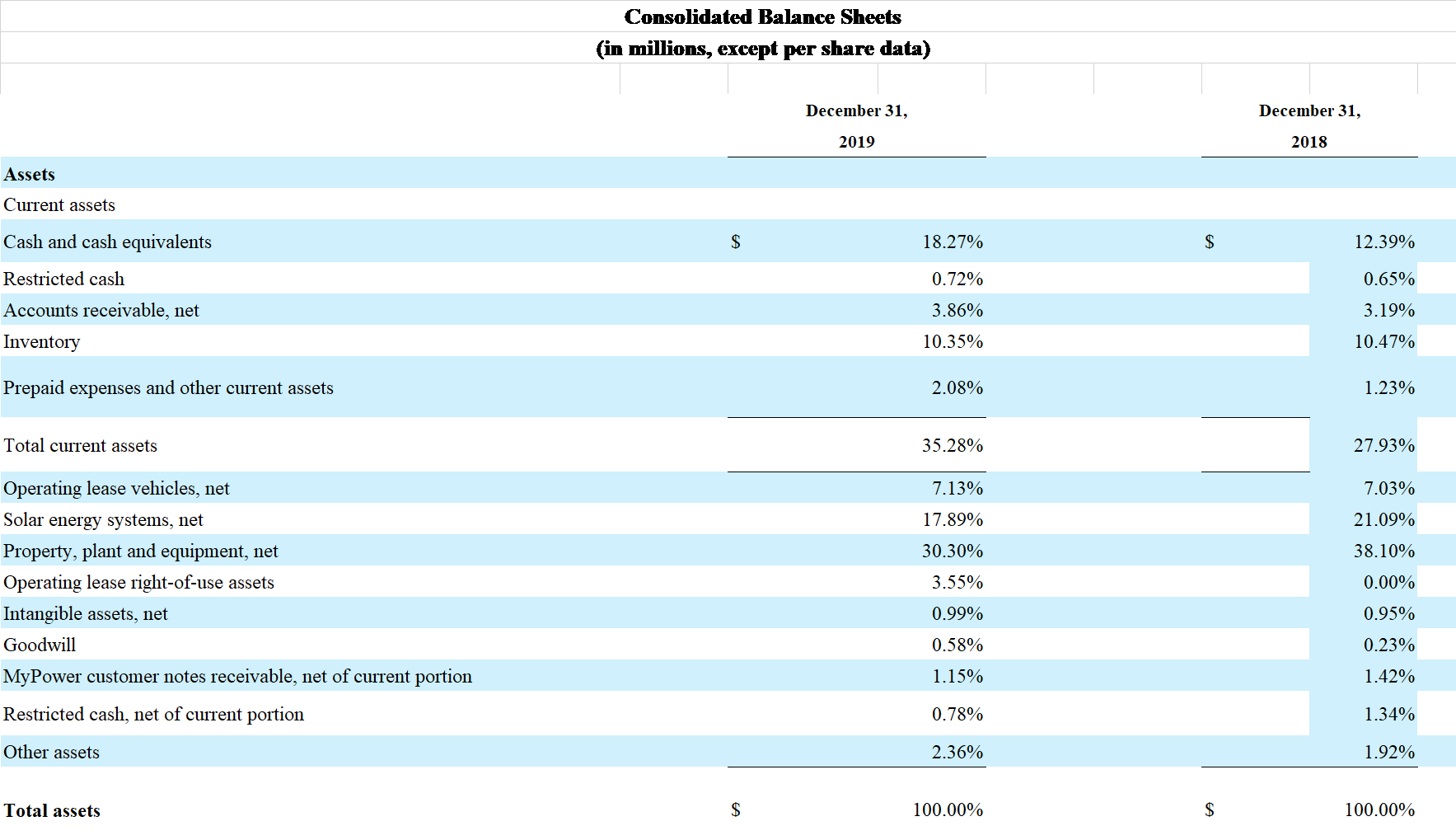

Liabilities Current liabilities Accounts payable Accrued liabilities and other Deferred revenue Resale value guarantees Customer deposits Current portion of debt and finance leases $ 10.99% $ 11.45% 8.47% 7.04% 3.39% 2.12% 0.92% 1.69% 2.12% 2.67% 5.20% 8.63% Total current liabilities 31.09% 33.60% Debt and finance leases, net of current portion 33.91% 31.62% Deferred revenue, net of current portion 3.52% 3.33% Resale value guarantees, net of current portion 0.10% 1.11% Other long-term liabilities 7.74% 9.11% Total liabilities 76.36% 78.77% Commitments and contingencies (Note 16) Redeemable noncontrolling interests in subsidiaries 1.87% 1.87% Equity Stockholders' equity Preferred stock; $0.001 par value; 100 shares authorized; no shares issued and outstanding Common stock; $0.001 par value; 2,000 shares authorized; 181 and 173 shares issued and outstanding as of December 31, 2019 and 2018, 0.00% 0.00% respectively Additional paid-in capital (37.12%) Accumulated other comprehensive loss (0.10%) 34.46% (0.03%) Accumulated deficit (17.73%) (17.88%) Total stockholders' equity 19.29% 16.55% Noncontrolling interests in subsidiaries Total liabilities and equity 2.47% 2.80% $ 100.00% $ 100.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts