Question: Find the data presented in Group Exercise 4 sheet in the Excel file. There are 4 bonds with different coupon rate and maturity but with

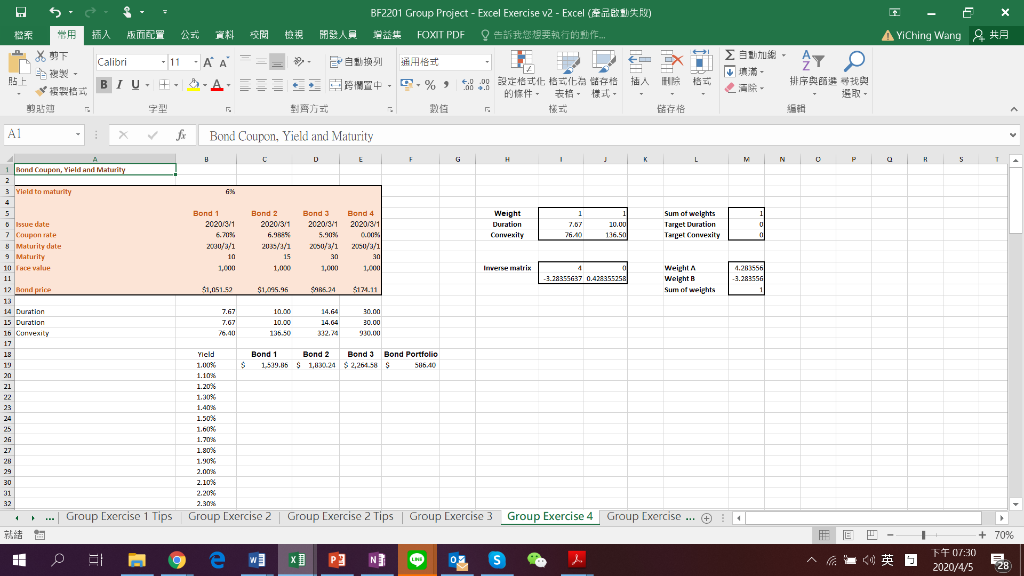

Find the data presented in Group Exercise 4 sheet in the Excel file. There are 4 bonds with different coupon rate and maturity but with the same YTM (Columns A-E and Rows 3-12). You have 1 Bond 2 today and thinking about hedging your position (sometimes called immunization). Excel does not provide any easy function to calculate duration and convexity. Functions bondprice, duration and secondDur are custom-made VBA functions. You may check it by pressing ALT + F11 when using the Excel file. (Using the function is not critical for this exercise. (Todays YTM is 6%)

4-1. By using the discounted cash flows are weights, calculate the Macaulay durations of the for bonds in (Bond 1 - Bond 4). Also, calculate the modified duration from this.

4-2. You have Bond2 and wish to immunize your portfolio to be delta-hedged. Use Bond 1 and Bond 3 to build two immunized portfolios (one with Bond 1 and 2 the other with Bond 2 and 3). Draw the P(y)s (Price-yield curve) of Bond2 and two immunized portfolios using yields from 1% to 15% with 10 bp increment. Explain your findings.

4-3. In the above exercise (4-2) calculate what is (should be) the cost of the immunization in each of the two cases? Explain the difference in P(y) in the two cases.

4-4. Now, you not only wish to hedge against delta but also with to hedge against convexity (called Gamma hedging). Use Bond 1 and Bond 3 along with Bond 2 to form delta and gamma hedged portfolio. Draw the P(y)s of Bond 2 and this immunized portfolio using yields from 1% to 15% with 10 bp increment. Compare the cost of hedging with your previous answers. Explain your findings. (Tips: Similar to duration, convexity of a portfolio is to be the weighted average convexity of each asset.)

4-5. Now, use Bond 4 to delta hedge Bond 2 instead of 1 or 3. Draw the P(y) of Bond 2 and this immunized portfolio. Compare the cost of hedging with your answers in 4-2. Explain your results.

4-6. Create delta and gamma hedged portfolio with Bond 1, 2 and 4 and do the same activities in 4-3. Compare the performance and hedging cost of your immunized portfolios from 4-2 to 4-6. Explain your results in detail (Tips: Do your best to infer the lessons from the above exercises).

| BF2201 Group Froject - Excel Exercise we - Excel ( FOXIT PDF a YiChing Wang 8 X (Calibi .11 -AA=== . , A. ,70 , %, BI,H,, * , ,, , , , : | : : X V & Bord Courvin, Yield and Maturity L M | N | e P a | R | Rond Coupen, Yield And Maturity 3 Yield to maturity Bond 1 | 11 Bond 2 02 ) Bond J 2013/ 1 .0% ACAU, all Bond 4 1 /1 1, | XTSU/3/1 Weight Duration Convexity 0 Issue date 7 Coupon rate 8 Maturity date 9 Maturity 10 value DL.DD 7 117.51] Sum of welghts Target Duration Target Convexity A01-11 2013-31 1. | 1.167 1.4M) 10ML mere matrix Weight Weight B Sum of weights | 12 ( 5 : | 3.28:55637 0.435:258 12 Bond price 1.75.95 95. A.11 7.67 14 Duration 15 Duration 16 Convexity | 10. 10.. 135- 1 14 - 14. E- 112 C 70 120) 101 Yidd 1. 1.10 Bond 1 1-19 135 Bond 2 : 1.1 221 Bond 3 22ht = Bond Portfolio 515.HD : 1.4 1. T. NI 1.7 13: 1.1 2. 3. Group Exercise 2 ... Group Exercise 1 Tips Group Exercise 2 Tips Group Exercise 3 Group Exercise 4 Group Exercise ... + - | - + 70% CUT:30 , 2020/4/5 28 02 S | BF2201 Group Froject - Excel Exercise we - Excel ( FOXIT PDF a YiChing Wang 8 X (Calibi .11 -AA=== . , A. ,70 , %, BI,H,, * , ,, , , , : | : : X V & Bord Courvin, Yield and Maturity L M | N | e P a | R | Rond Coupen, Yield And Maturity 3 Yield to maturity Bond 1 | 11 Bond 2 02 ) Bond J 2013/ 1 .0% ACAU, all Bond 4 1 /1 1, | XTSU/3/1 Weight Duration Convexity 0 Issue date 7 Coupon rate 8 Maturity date 9 Maturity 10 value DL.DD 7 117.51] Sum of welghts Target Duration Target Convexity A01-11 2013-31 1. | 1.167 1.4M) 10ML mere matrix Weight Weight B Sum of weights | 12 ( 5 : | 3.28:55637 0.435:258 12 Bond price 1.75.95 95. A.11 7.67 14 Duration 15 Duration 16 Convexity | 10. 10.. 135- 1 14 - 14. E- 112 C 70 120) 101 Yidd 1. 1.10 Bond 1 1-19 135 Bond 2 : 1.1 221 Bond 3 22ht = Bond Portfolio 515.HD : 1.4 1. T. NI 1.7 13: 1.1 2. 3. Group Exercise 2 ... Group Exercise 1 Tips Group Exercise 2 Tips Group Exercise 3 Group Exercise 4 Group Exercise ... + - | - + 70% CUT:30 , 2020/4/5 28 02 S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts