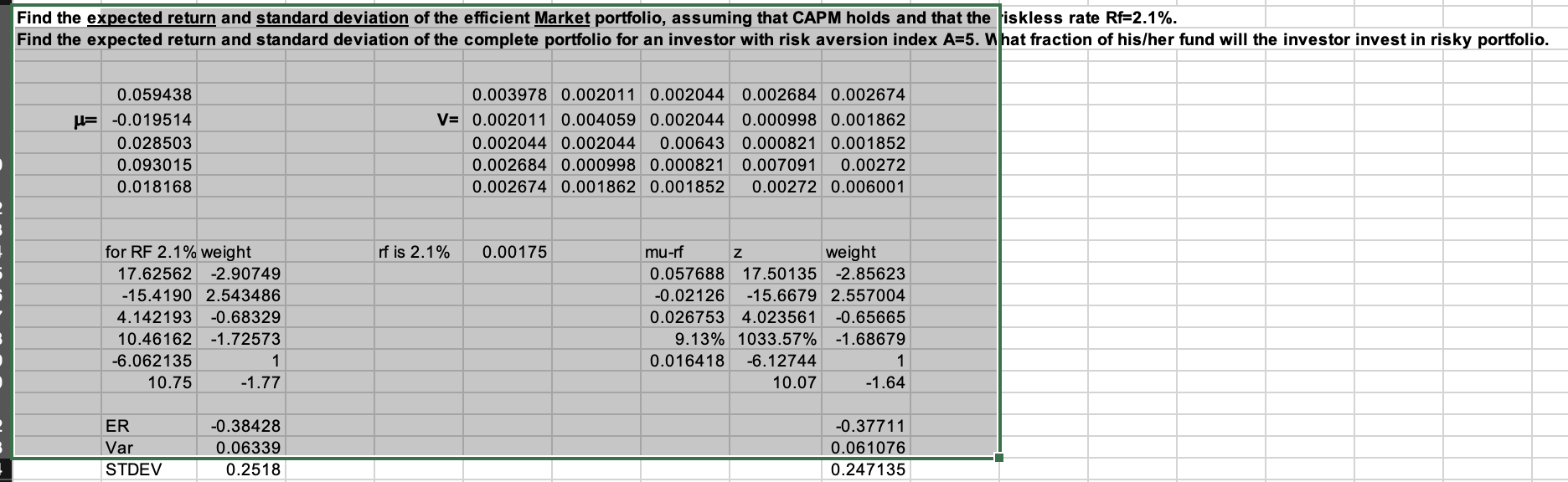

Question: Find the expected return and standard deviation of the efficient Market portfolio, assuming that CAPM holds and that the iskless rate Rf=2.1%. Find the expected

Find the expected return and standard deviation of the efficient Market portfolio, assuming that CAPM holds and that the iskless rate Rf=2.1%. Find the expected return and standard deviation of the complete portfolio for an investor with risk aversion index A=5. What fraction of his/her fund will the investor invest in risky portfolio. 0.059438 u= -0.019514 0.028503 0.093015 0.018168 0.003978 0.002011 0.002044 0.002684 0.002674 V= 0.002011 0.004059 0.002044 0.000998 0.001862 0.002044 0.002044 0.00643 0.000821 0.001852 0.002684 0.000998 0.000821 0.007091 0.00272 0.002674 0.001862 0.001852 0.00272 0.006001 rf is 2.1% 0.00175 for RF 2.1% weight 17.62562 -2.90749 -15.4190 2.543486 4.142193 -0.68329 10.46162 -1.72573 -6.062135 1 10.75 -1.77 mu-rf Z weight 0.057688 17.50135 -2.85623 -0.02126 -15.6679 2.557004 0.026753 4.023561 -0.65665 9.13% 1033.57% -1.68679 0.016418 -6.12744 1 10.07 -1.64 ER Var STDEV -0.38428 0.06339 0.2518 -0.37711 0.061076 0.247135 Find the expected return and standard deviation of the efficient Market portfolio, assuming that CAPM holds and that the iskless rate Rf=2.1%. Find the expected return and standard deviation of the complete portfolio for an investor with risk aversion index A=5. What fraction of his/her fund will the investor invest in risky portfolio. 0.059438 u= -0.019514 0.028503 0.093015 0.018168 0.003978 0.002011 0.002044 0.002684 0.002674 V= 0.002011 0.004059 0.002044 0.000998 0.001862 0.002044 0.002044 0.00643 0.000821 0.001852 0.002684 0.000998 0.000821 0.007091 0.00272 0.002674 0.001862 0.001852 0.00272 0.006001 rf is 2.1% 0.00175 for RF 2.1% weight 17.62562 -2.90749 -15.4190 2.543486 4.142193 -0.68329 10.46162 -1.72573 -6.062135 1 10.75 -1.77 mu-rf Z weight 0.057688 17.50135 -2.85623 -0.02126 -15.6679 2.557004 0.026753 4.023561 -0.65665 9.13% 1033.57% -1.68679 0.016418 -6.12744 1 10.07 -1.64 ER Var STDEV -0.38428 0.06339 0.2518 -0.37711 0.061076 0.247135

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts