Question: QUESTION 16 Please use the following scenario to answer question 16 and question 17. Suppose the market return is 104, and the risk free rate

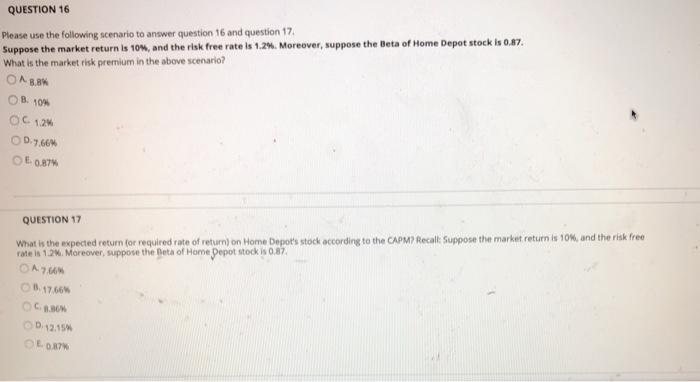

QUESTION 16 Please use the following scenario to answer question 16 and question 17. Suppose the market return is 104, and the risk free rate is 1.24. Moreover, suppose the Beta of Home Depot stock is 0.87 What is the market risk premium in the above scenario? O3.8 OB. 10 OC 12 OD.7661 OE0.87 QUESTION 17 What is the expected return for required rate of return) on Home Depots stock according to the CAPM? Recall Suppose the market return is 10%, and the risk free rate is 1.2. Moreover, suppose the Data of Home Depot stock is 0,8%. 8.17.66% C. 0.12.15 LOX7

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock