Question: Find the following information using given bond data: Maturity date coupon rate Calculate: Using the nominal value, Maturity and coupon rate (from Markets Insider), calculate

Find the following information using given bond data:

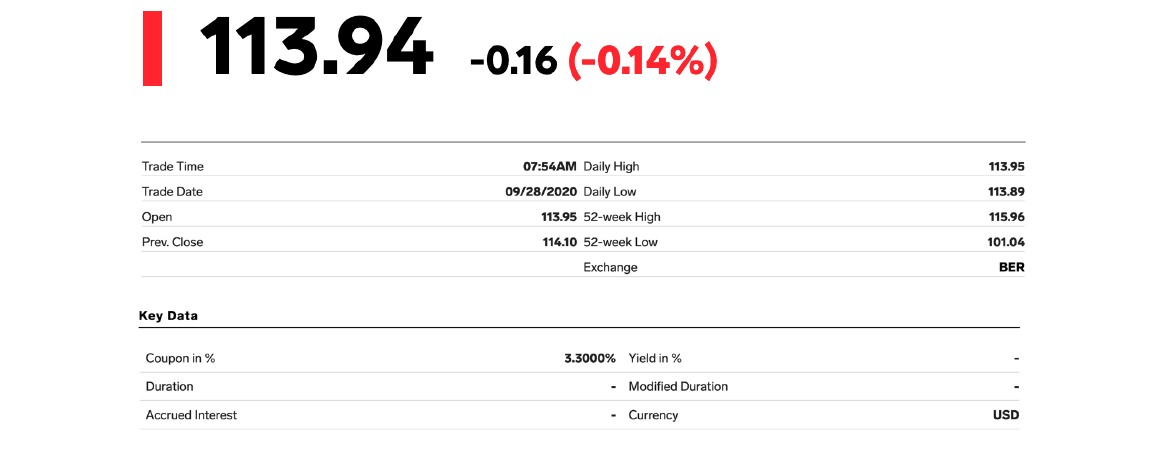

- Maturity date

- coupon rate

Calculate:

- Using the nominal value, Maturity and coupon rate (from Markets Insider), calculate the Yield to Maturity (using the rate function from excel). Include your excel screenshot.

Identify:

- Is your Bond a premium or discount bond?

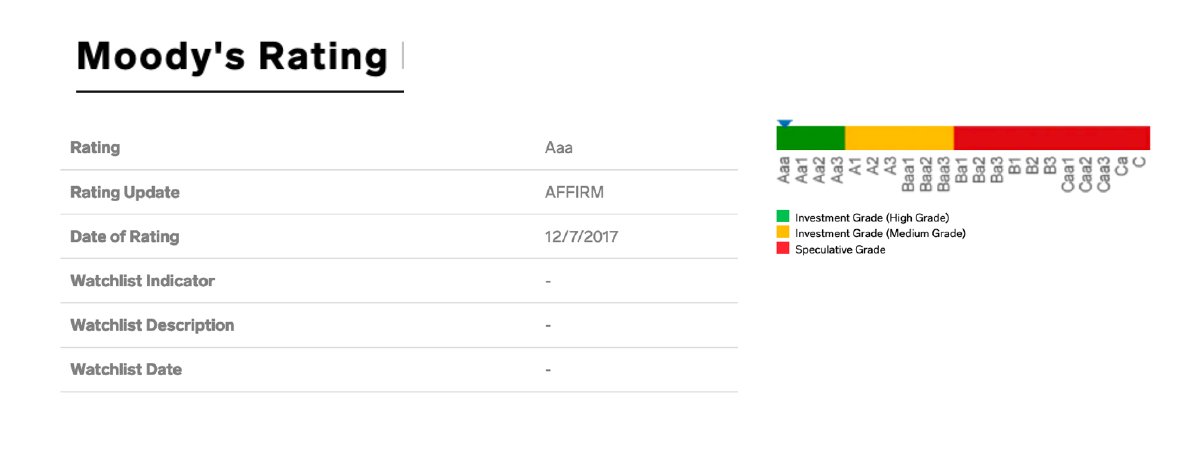

- What is the rating of your companys Bond? If available

- What type of Interest rate (fixed or floating) is your Bond? If available

Explain:

- Does this type of Bond and features attract you as an investor? Why? Why not? Explain.

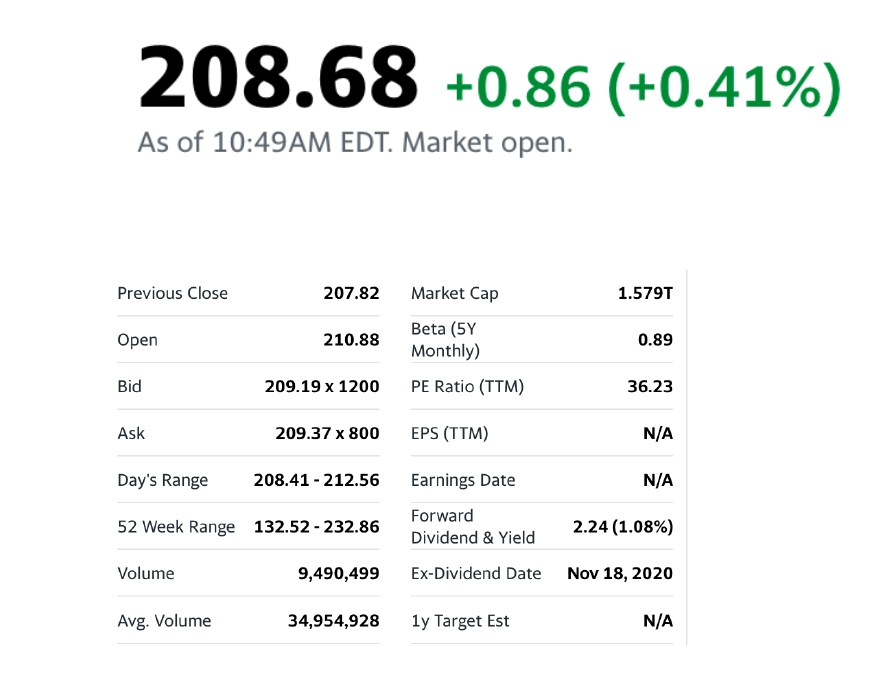

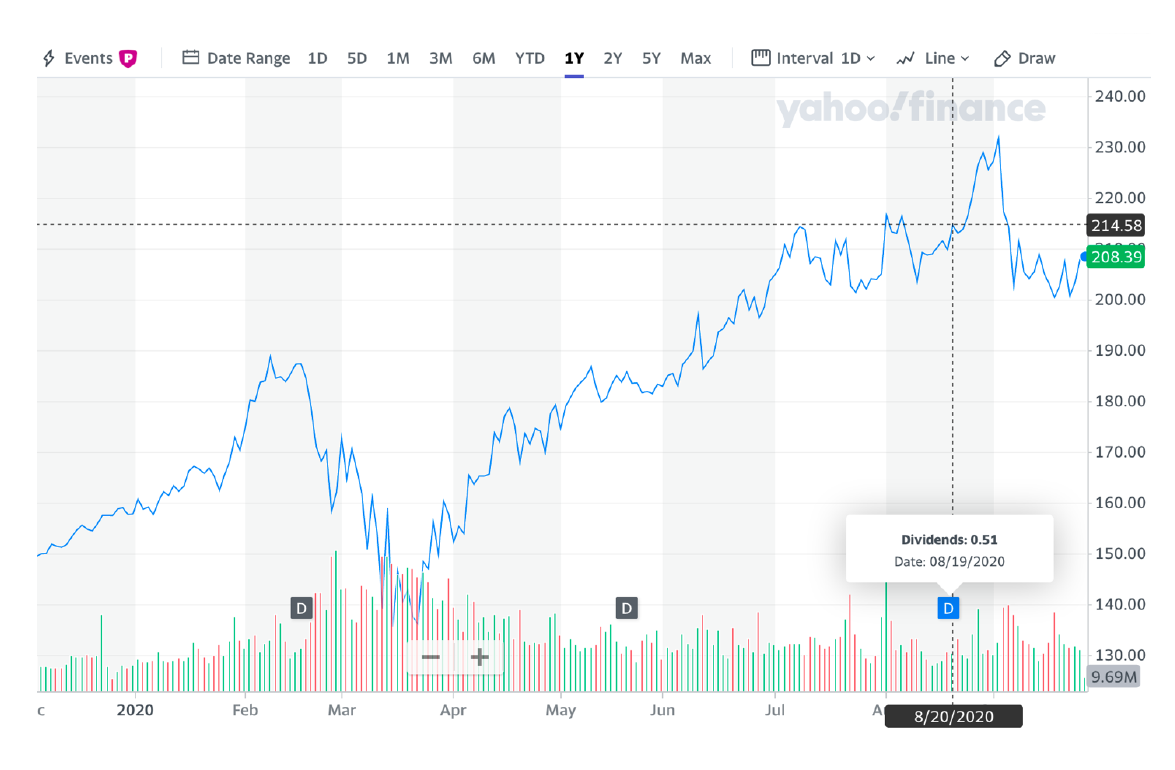

| 113.94 -0.16 (-0.14%) Trade Time 07:54AM Daily High 113.95 Trade Date 113.89 09/28/2020 Daily Low 113.95 52-week High Open 115.96 Prev. Close 114.10 52-week Low 101.04 Exchange BER Key Data Coupon in % 3.3000% Yield in % Duration - Modified Duration Accrued Interest - Currency USD Bond Data Country USA Issue Volume 4,000,000,000 Currency USD Issue Price 99.65 Issue Date 2/6/2017 COUPON Coupon 3.300% Denomination 1000 Quotation Type Payment Type regular interest Special Coupon Type Maturity Date 2/6/2027 Coupon Payment Date 2/6/2021 Payment Frequency No. of Payments per Year 2.0 Coupon Start Date 8/6/2017 Final Coupon Date 2/5/2027 Floater? No Moody's Rating Rating B2 Rating Update AFFIRM Date of Rating 12/7/2017 Investment Grade (High Grade) Investment Grade (Medium Grade) Speculative Grade Watchlist Indicator Watchlist Description Watchlist Date 208.68 +0.86 (+0.41%) As of 10:49AM EDT. Market open. Previous Close 207.82 1.579T Open 210.88 Market Cap Beta (5Y Monthly) PE Ratio (TTM) 0.89 Bid 209.19 x 1200 36.23 Ask 209.37 x 800 EPS (TTM) N/A Day's Range 208.41 - 212.56 N/A Earnings Date Forward Dividend & Yield 52 Week Range 132.52 - 232.86 2.24 (1.08%) Volume 9,490,499 Ex-Dividend Date Nov 18, 2020 Avg. Volume 34,954,928 1y Target Est N/A Events Date Range 1D 5D 1M 6M YTD 1Y 2Y 5Y Max Interval 1D w Line o Draw 240.00 yahoo/finance 230.00 220.00 214.58 208.39 200.00 190.00 180.00 170.00 160.00 Dividends: 0.51 Date: 08/19/2020 150.00 D D 140.00 - + 130.00 9.69M 2020 Feb Mar Apr May Jun Jul A 8/20/2020 | 113.94 -0.16 (-0.14%) Trade Time 07:54AM Daily High 113.95 Trade Date 113.89 09/28/2020 Daily Low 113.95 52-week High Open 115.96 Prev. Close 114.10 52-week Low 101.04 Exchange BER Key Data Coupon in % 3.3000% Yield in % Duration - Modified Duration Accrued Interest - Currency USD Bond Data Country USA Issue Volume 4,000,000,000 Currency USD Issue Price 99.65 Issue Date 2/6/2017 COUPON Coupon 3.300% Denomination 1000 Quotation Type Payment Type regular interest Special Coupon Type Maturity Date 2/6/2027 Coupon Payment Date 2/6/2021 Payment Frequency No. of Payments per Year 2.0 Coupon Start Date 8/6/2017 Final Coupon Date 2/5/2027 Floater? No Moody's Rating Rating B2 Rating Update AFFIRM Date of Rating 12/7/2017 Investment Grade (High Grade) Investment Grade (Medium Grade) Speculative Grade Watchlist Indicator Watchlist Description Watchlist Date 208.68 +0.86 (+0.41%) As of 10:49AM EDT. Market open. Previous Close 207.82 1.579T Open 210.88 Market Cap Beta (5Y Monthly) PE Ratio (TTM) 0.89 Bid 209.19 x 1200 36.23 Ask 209.37 x 800 EPS (TTM) N/A Day's Range 208.41 - 212.56 N/A Earnings Date Forward Dividend & Yield 52 Week Range 132.52 - 232.86 2.24 (1.08%) Volume 9,490,499 Ex-Dividend Date Nov 18, 2020 Avg. Volume 34,954,928 1y Target Est N/A Events Date Range 1D 5D 1M 6M YTD 1Y 2Y 5Y Max Interval 1D w Line o Draw 240.00 yahoo/finance 230.00 220.00 214.58 208.39 200.00 190.00 180.00 170.00 160.00 Dividends: 0.51 Date: 08/19/2020 150.00 D D 140.00 - + 130.00 9.69M 2020 Feb Mar Apr May Jun Jul A 8/20/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts