Question: Find the net Equivalent Uniform Benefit (EUB) or net Equivalent Uniform Cost (EUC) for Project A and for Project B over a seventy-seven-year period. And

Find the net Equivalent Uniform Benefit (EUB) or net Equivalent Uniform Cost (EUC) for Project A and for Project B over a seventy-seven-year period. And using the net EUB (EUC) , which project is better?

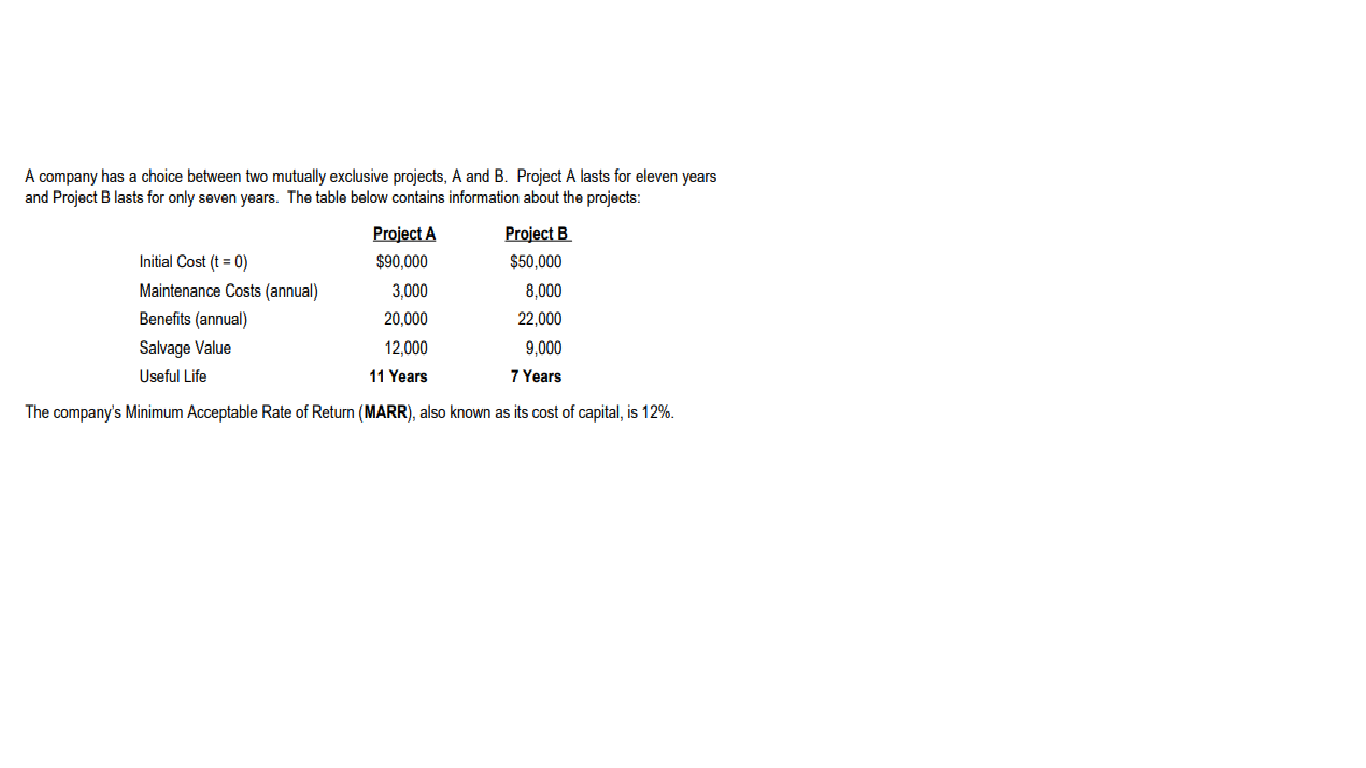

company has a choice between two mutually exclusive projects, A and B. Project lasts for eleven years and Project Blasts for only seven years. The table below contains information about the projects: Initial Cost (t = 0) Maintenance Costs (annual) Benefits (annual) Salvage Value Useful Life Project A $90,000 3,000 20.000 12,000 Project B $50,000 8,000 22.000 9,000 11 Years 7 Years The company's Minimum Acceptable Rate of Return (MARR), also known as its cost of capital, is 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts