Question: First, the picture is problem 12. and i need problem 13's answer. 13. Customers, such as Problem 12 above, have decided to invest a percentage

a. What is the investment ratio y?

b. What is the ratio of customers' investment in three stocks and financial securities funds?

c. What is the standard deviation of the return on investment in the customer portfolio?

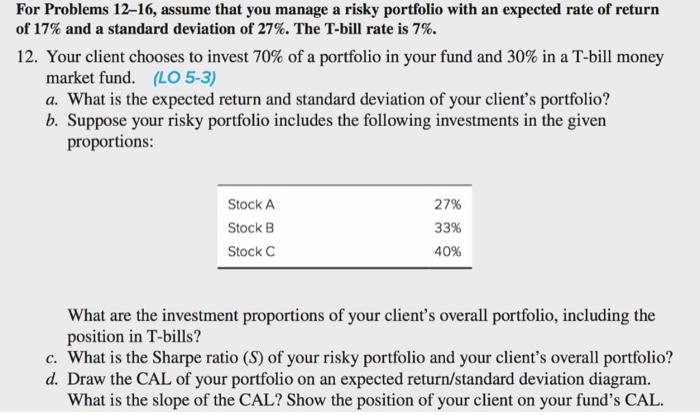

For Problems 12-16, assume that you manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 27%. The T-bill rate is 7%. 12. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. (LO 5-3) a. What is the expected return and standard deviation of your client's portfolio? b. Suppose your risky portfolio includes the following investments in the given proportions: Stock A Stock B Stock C 27% 33% 40% What are the investment proportions of your client's overall portfolio, including the position in T-bills? c. What is the Sharpe ratio (S) of your risky portfolio and your client's overall portfolio? d. Draw the CAL of your portfolio on an expected return/standard deviation diagram. What is the slope of the CAL? Show the position of your client on your fund's CAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts