Question: five years. 1. Your firm has determined that it will need to replace its remote data storage facilty in The cost in five years will

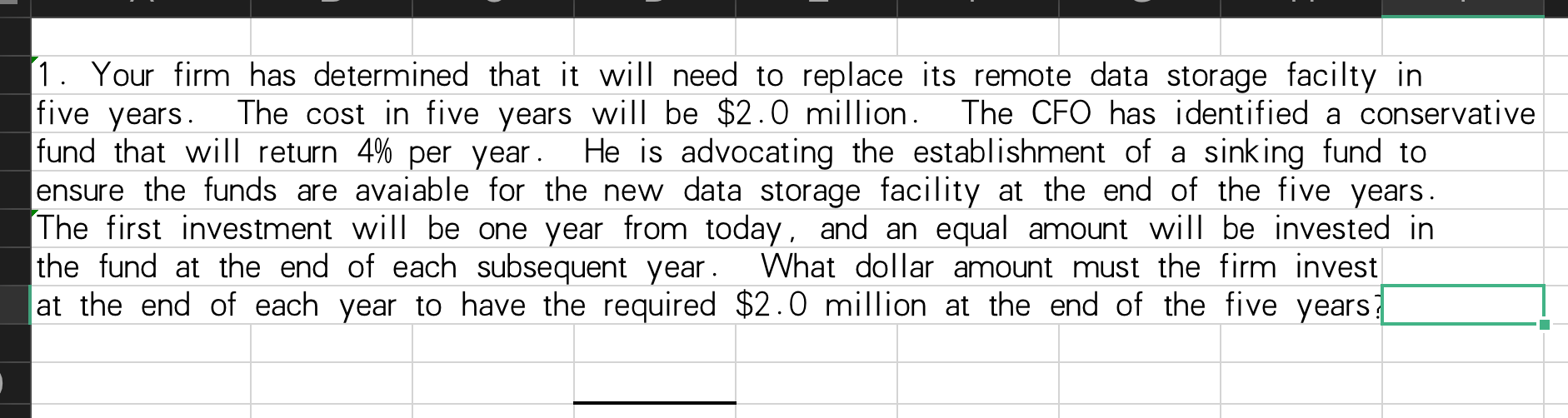

five years. 1. Your firm has determined that it will need to replace its remote data storage facilty in The cost in five years will be $2.0 million. The CFO has identified a conservative fund that will return 4% per year. He is advocating the establishment of a sinking fund to ensure the funds are avaiable for the new data storage facility at the end of the five years. The first investment will be one year from today, and an equal amount will be invested in the fund at the end of each subsequent year. What dollar amount must the firm invest at the end of each year to have the required $2.0 million at the end of the five years

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock