Question: Fixed exchange rates Consider the exchange rate between the Philippine peso and the euro. Suppose the Philippine government and the Eurozone governments agree to fix

Fixed exchange rates

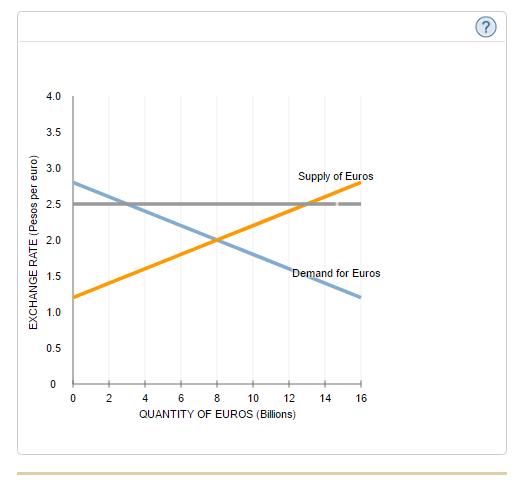

Consider the exchange rate between the Philippine peso and the euro. Suppose the Philippine government and the Eurozone governments agree to fix the exchange rate at 2.5 pesos per euro, as shown by the grey line on the following graph. Refer to the following graph when answering the questions that follow

.

At the official exchange rate of 2.5 pesos per euro, the euro is (overvalued or undervalued), and the Philippine peso is (overvalued or undervalued), which means that Filipinos pay (less or more) for European exports than they would with a free-floating exchange rate.

At the official peso price of euros, there is a (shortage or surplus) of euros in the foreign exchange market.

Suppose the governments in the Eurozone and the Philippines agree to change the official exchange rate from 2.5 pesos per euro to 2 pesos per euro. The action represents a (devaluation or revaluation) of the euro and a (devaluation or revaluation) of the peso.

EXCHANGE RATE (Pesos per euro) 4.0 3.5 3.0 Supply of Euros 2.5 2.0 1.5 1.0 0.5 0 0 2 4 6 8 10 Demand for Euros 12 14 14 QUANTITY OF EUROS (Billions) 16 ?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts