Question: For a use the formula and show your working out (no excel) b) Plot the yield curve and the forward rates. Comment on the shape

For a use the formula and show your working out (no excel)

b) Plot the yield curve and the forward rates. Comment on the shape of the yield curve and explain what theory of the term structure of interest rates could best explain this shape.

c) Construct a 1-year forward loan beginning in year 3. Assume that you are the borrower in this arrangement, and that you borrow 1,000 which needs to be returned in year 4. What is the rate of interest on this loan?

d) Consider a pension fund that has to pay a fixed amount Q in three and a half years. Assume the yield curve is flat at 5% and the fund manager is considering immunising his investment. He has the following four bonds to choose from: Bond 1: a 25% annual coupon corporate bond that matures in 4 years Bond 2: a 11% annual coupon bond that matures in 4 years Bond 3: a Perpetuity with a yield to maturity of 20% Bond 4: a Zero-coupon bond that matures in 2 years. Determine which single bond provides the best match for immunising the pension fund.

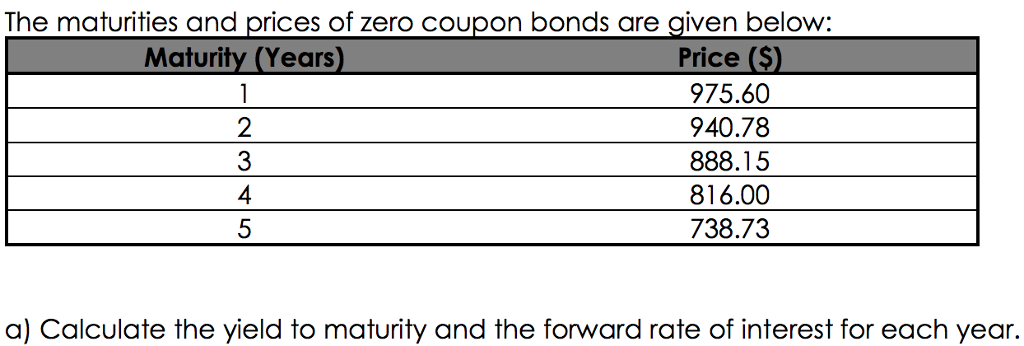

The maturities and prices of zero coupon bonds are given below: Maturity (Years) 2 4 Price ($) 975.60 940.78 888.15 816.00 738.73 a) Calculate the yield to maturity and the forward rate of interest for each year The maturities and prices of zero coupon bonds are given below: Maturity (Years) 2 4 Price ($) 975.60 940.78 888.15 816.00 738.73 a) Calculate the yield to maturity and the forward rate of interest for each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts