Question: For all questions, answer them based on per share price, per share premium, and etc. 1. Jane purchased 100 shares of Netflix, Inc. (Ticker: NFLX)

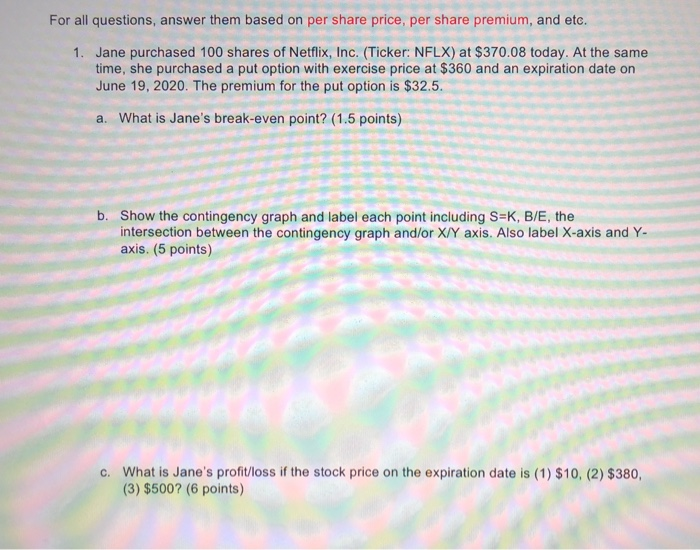

For all questions, answer them based on per share price, per share premium, and etc. 1. Jane purchased 100 shares of Netflix, Inc. (Ticker: NFLX) at $370.08 today. At the same time, she purchased a put option with exercise price at $360 and an expiration date on June 19, 2020. The premium for the put option is $32.5. a. What is Jane's break-even point? (1.5 points) b. Show the contingency graph and label each point including S=K, B/E, the intersection between the contingency graph and/or X/Y axis. Also label X-axis and Y- axis. (5 points) c. What is Jane's profit/loss if the stock price on the expiration date is (1) $10, (2) $380, (3) $500? (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts