Question: FOR EACH PROBLEM: 1.Perform the type of analysis indicated in the problem (Present Worth, Annual Worth, Benefit-Cost, Rate of Return, Payback). If none is indicated,

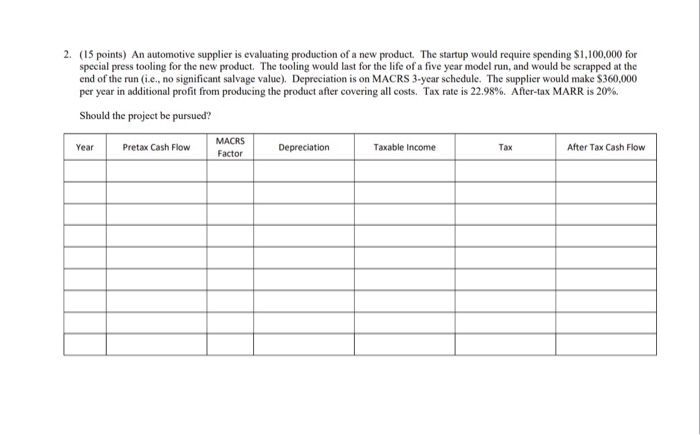

FOR EACH PROBLEM: 1.Perform the type of analysis indicated in the problem (Present Worth, Annual Worth, Benefit-Cost, Rate of Return, Payback). If none is indicated, you may use any appropriate method. 2. Show the financial equivalence functions for each term of your analysis (e.g. P/A(, n)) 3. If you need to continue your work on an additional page, make sure to include that work in your test package 2. (15 points) An automotive supplier is evaluating production of a new product. The startup would require spending $1,100,000 for special press tooling for the new product. The tooling would last for the life of a five year model run, and would be scrapped at the end of the run (i.e., no significant salvage value). Depreciation is on MACRS 3-year schedule. The supplier would make $360,000 per year in additional profit from producing the product after covering all costs. Tax rate is 22.98%. After-tax MARR is 20%. Should the project be pursued? Year Pretax Cash Flow MACRS Factor Depreciation Taxable income After Tax Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts