Question: For example, the returns on Country B's index are given in Exhibit 35 as 7.8, 6.3, and -1.5 percent. Putting the returns into decimal form

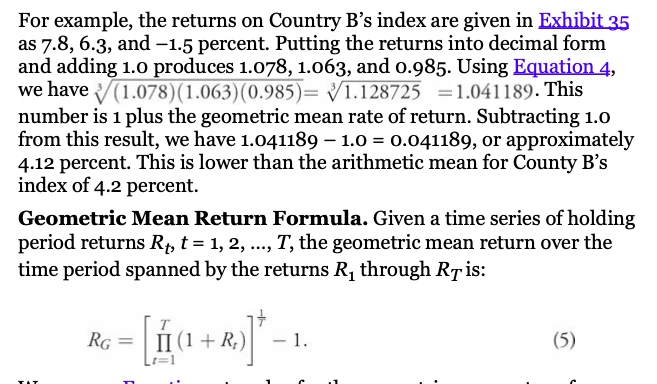

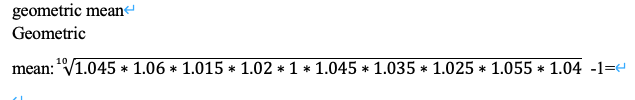

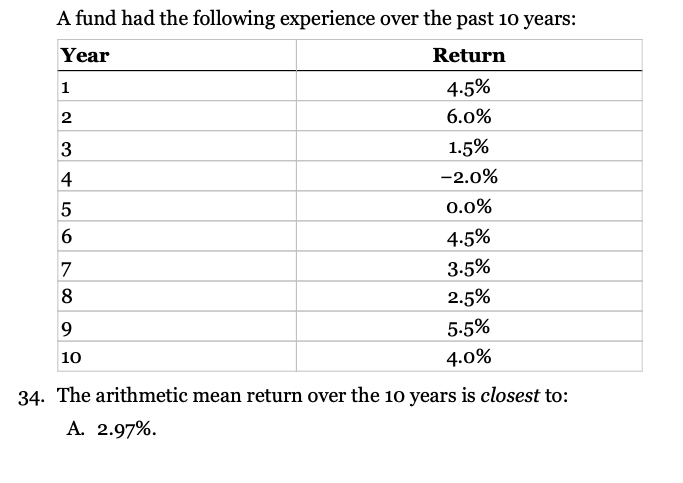

For example, the returns on Country B's index are given in Exhibit 35 as 7.8, 6.3, and -1.5 percent. Putting the returns into decimal form and adding 1.o produces 1.078, 1.063, and 0.985. Using Equation 4, we have (1.078)(1.063)(0.985)= V1.128725 = 1.041189. This number is 1 plus the geometric mean rate of return. Subtracting 1.0 from this result, we have 1.041189 - 1.0 = 0.041189, or approximately 4.12 percent. This is lower than the arithmetic mean for County B's index of 4.2 percent. Geometric Mean Return Formula. Given a time series of holding period returns Rt, t = 1, 2, ..., T, the geometric mean return over the time period spanned by the returns R, through Ris: RG -- [ju +r)*-- ] II (1 -1. (5) TT geometric mean Geometric 10 mean: "V1.045 * 1.06 * 1.015 * 1.02 *1 * 1.045 * 1.035 * 1.025 * 1.055 * 1.04 -1=4 A fund had the following experience over the past 10 years: Year Return 1 4.5% 2 6.0% 3 1.5% 4 -2.0% 5 0.0% 6 4.5% 7 3.5% 8 2.5% 9 5.5% 4.0% 34. The arithmetic mean return over the 10 years is closest to: A. 2.97%. 10 B. 3.00%. C. 3-33%. 35. The geometric mean return over the 10 years is closest to: A. 2.94%. B. 2.97%. C. 3.00%. 37. The standard deviation of the 10 years of returns is closest to: A. 2.40%. B. 2.53%. C. 7.58%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts