Question: For the base case in this section, as a percentage of sales, COGS = 70 percent, SGA = 14 percent, R&D = 2.8 percent.

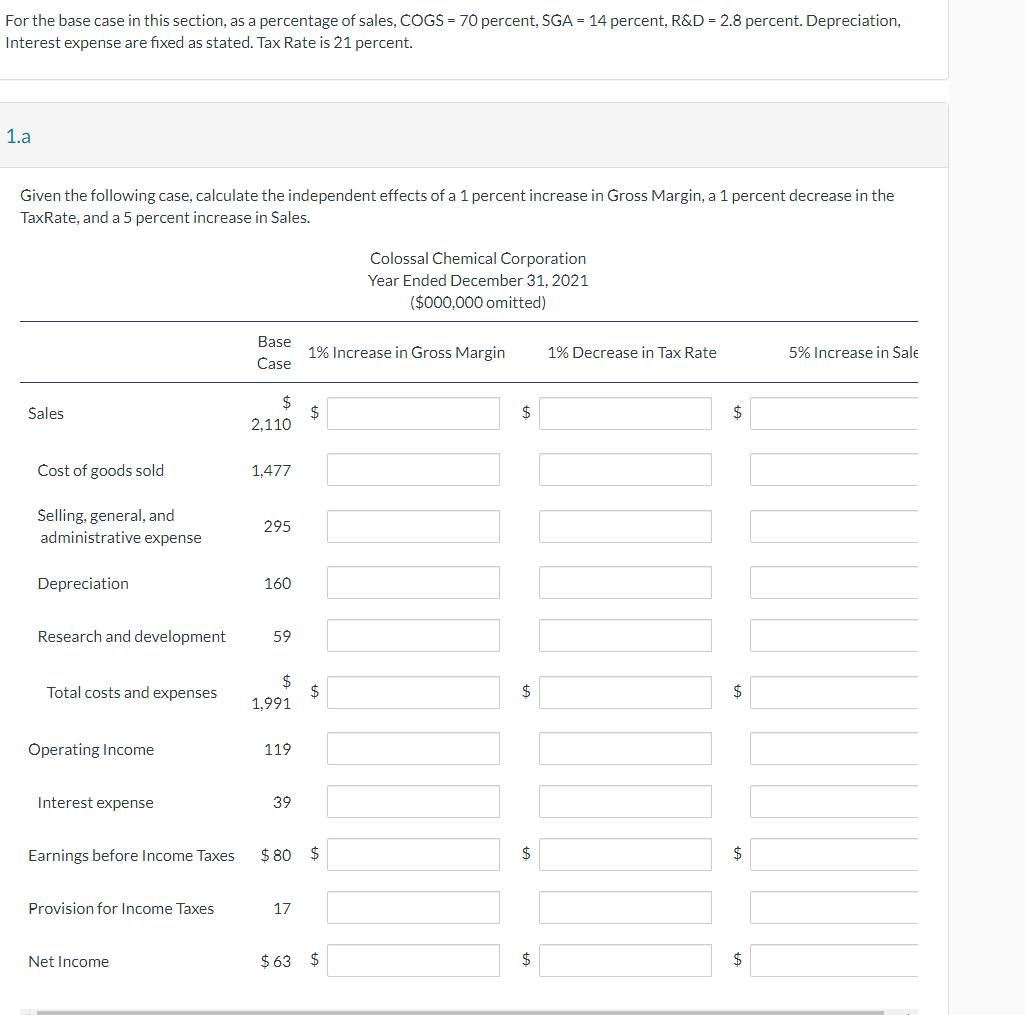

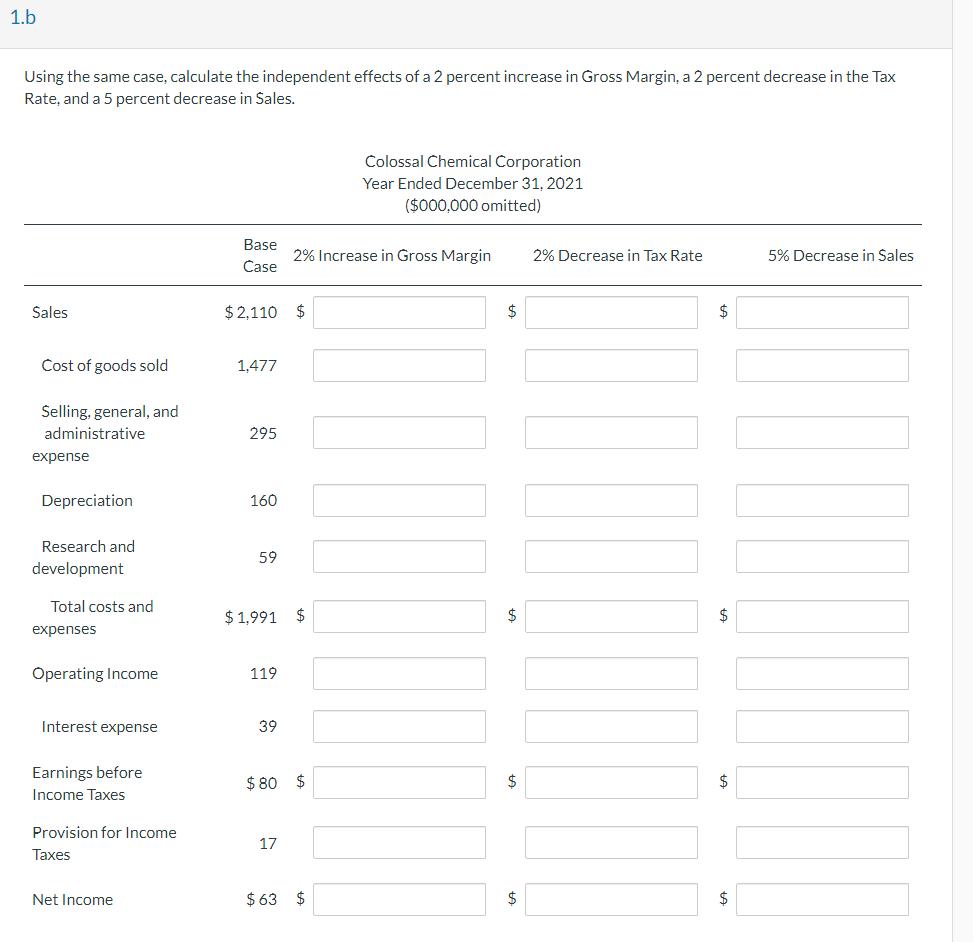

For the base case in this section, as a percentage of sales, COGS = 70 percent, SGA = 14 percent, R&D = 2.8 percent. Depreciation, Interest expense are fixed as stated. Tax Rate is 21 percent. 1.a Given the following case, calculate the independent effects of a 1 percent increase in Gross Margin, a 1 percent decrease in the TaxRate, and a 5 percent increase in Sales. Sales Cost of goods sold Selling, general, and administrative expense Depreciation Research and development Total costs and expenses Operating Income Interest expense Earnings before Income Taxes Provision for Income Taxes Net Income Base Case $ 2,110 1,477 295 160 59 $ 1,991 119 39 17 1% Increase in Gross Margin $ $ $80 $ Colossal Chemical Corporation Year Ended December 31, 2021 ($000,000 omitted) $63 $ $ $ $ $ 1% Decrease in Tax Rate $ $.. $ $ 5% Increase in Sale 1.b Using the same case, calculate the independent effects of a 2 percent increase in Gross Margin, a 2 percent decrease in the Tax Rate, and a 5 percent decrease in Sales. Sales Cost of goods sold Selling, general, and administrative expense Depreciation Research and development Total costs and expenses Operating Income Interest expense Earnings before Income Taxes Provision for Income Taxes Net Income Base Case $2,110 1.477 295 160 59 119 $1,991 $ 39 2% Increase in Gross Margin $ 17 $80 $ Colossal Chemical Corporation Year Ended December 31, 2021 ($000,000 omitted) $63 $ $ $ $ $ 2% Decrease in Tax Rate $ $ $ 5% Decrease in Sales

Step by Step Solution

There are 3 Steps involved in it

1 The Effects of a 1 percent increase in Gross Margin a 1 percent decrease in the T... View full answer

Get step-by-step solutions from verified subject matter experts