Question: For the three main U.S. Asset Classes: (1) Equities, (2) Fixed Income Securities, and (3) Real Estate quantify the return, risk, and correlation matrix across

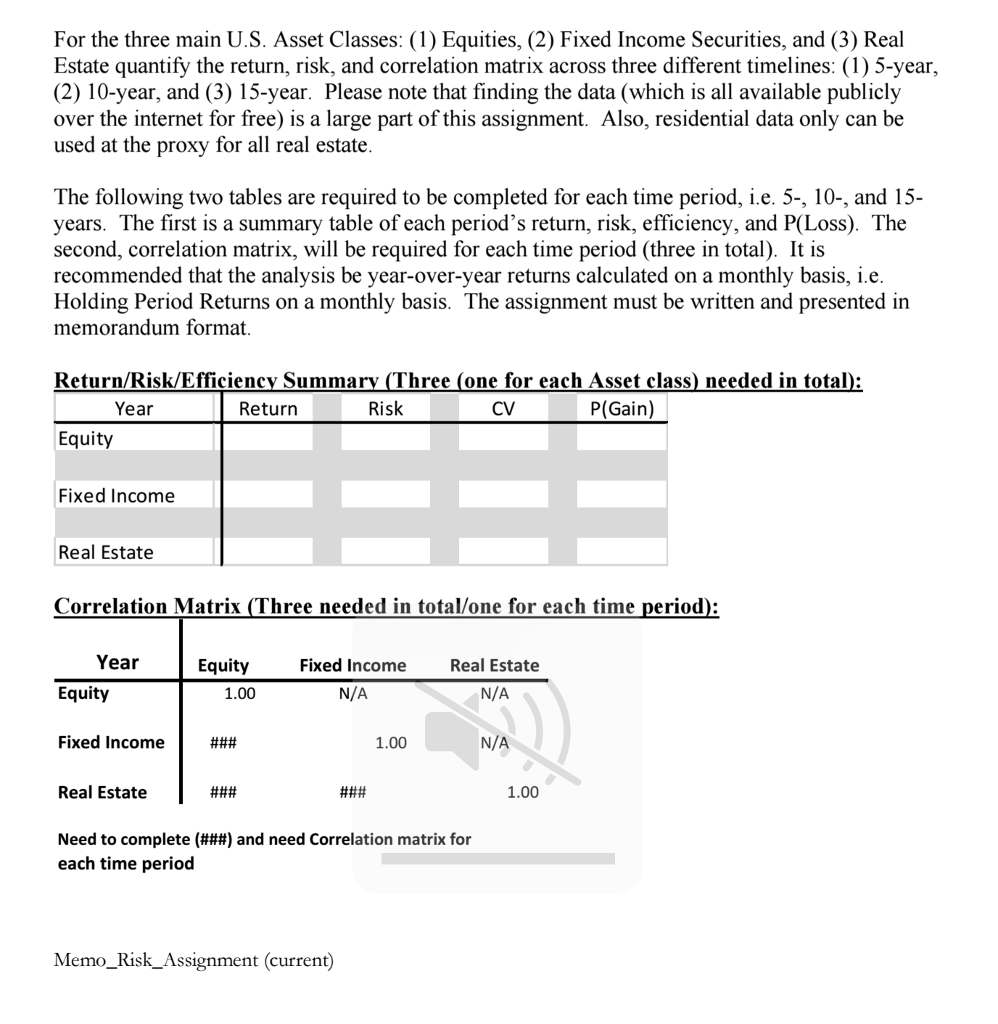

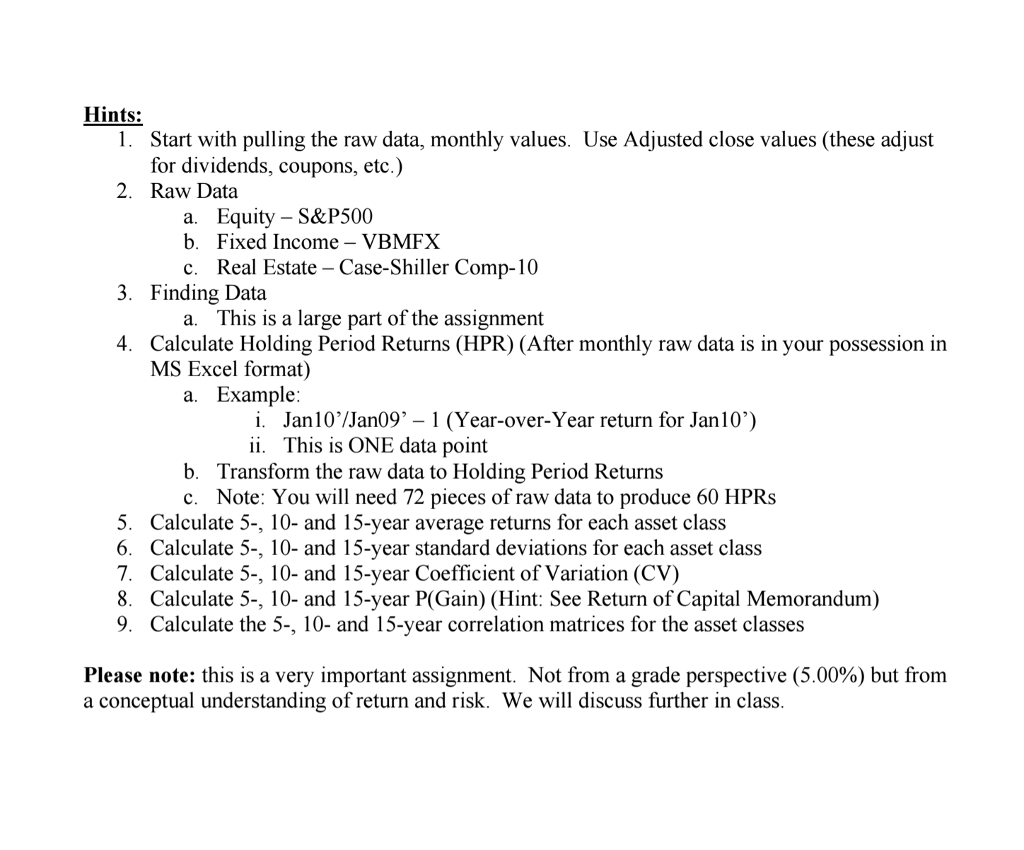

For the three main U.S. Asset Classes: (1) Equities, (2) Fixed Income Securities, and (3) Real Estate quantify the return, risk, and correlation matrix across three different timelines: (1) 5-year, (2) 10-year, and (3) 15-year. Please note that finding the data (which is all available publicly over the internet for free) is a large part of this assignment. Also, residential data only can be used at the proxy for all real estate The following two tables are required to be completed for each time period, i.e. 5-, 10-, and 15- years. The first is a summary table of each period's return, risk, efficiency, and P(Loss). The second, correlation matrix, will be required for each time period (three in total). It is recommended that the analysis be year-over-year returns calculated on a monthly basis, i.e. Holding Period Returns on a monthly basis. The assignment must be written and presented in memorandum format Return/Risk/Efficiency Summar Three (one for each Asset class) needed in total): P(Gain) Year Return Risk CV Equity Fixed Income Real Estate Correlation Matrix (Three needed in total/one for each time period): Year Equity 1.00 Fixed Income Real Estate Equity N/A N/A Fixed Income 1.00 N/A Real Estate 1.00 Need to complete (###) and need Correlation matrix for each time period Memo_Risk_Assignment (current) For the three main U.S. Asset Classes: (1) Equities, (2) Fixed Income Securities, and (3) Real Estate quantify the return, risk, and correlation matrix across three different timelines: (1) 5-year, (2) 10-year, and (3) 15-year. Please note that finding the data (which is all available publicly over the internet for free) is a large part of this assignment. Also, residential data only can be used at the proxy for all real estate The following two tables are required to be completed for each time period, i.e. 5-, 10-, and 15- years. The first is a summary table of each period's return, risk, efficiency, and P(Loss). The second, correlation matrix, will be required for each time period (three in total). It is recommended that the analysis be year-over-year returns calculated on a monthly basis, i.e. Holding Period Returns on a monthly basis. The assignment must be written and presented in memorandum format Return/Risk/Efficiency Summar Three (one for each Asset class) needed in total): P(Gain) Year Return Risk CV Equity Fixed Income Real Estate Correlation Matrix (Three needed in total/one for each time period): Year Equity 1.00 Fixed Income Real Estate Equity N/A N/A Fixed Income 1.00 N/A Real Estate 1.00 Need to complete (###) and need Correlation matrix for each time period Memo_Risk_Assignment (current)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts