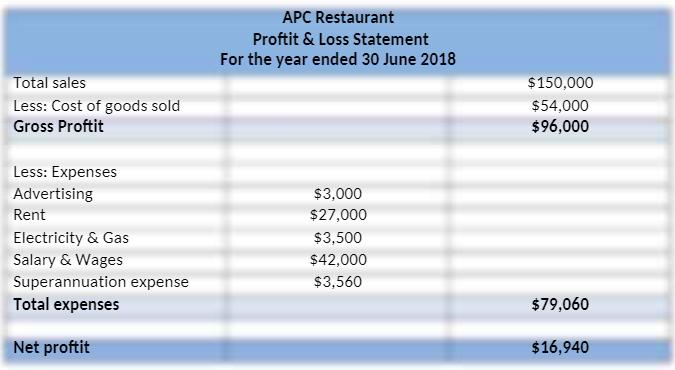

For the year ended 30 June 2018, the business income and expenses for APC Restaurant are shown

Fantastic news! We've Found the answer you've been seeking!

Question:

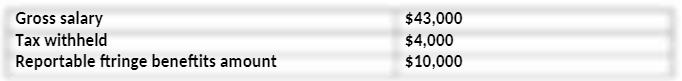

Peter also provides you the following information for his tax return purpose. Besides his own business, Peter is also working as a kitchen hands in another restaurant. His PAYG Summary (previously known as group certificate) shows the following information:

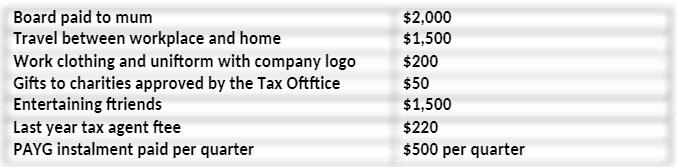

Peter has the following other receipts:

The following table shows the information about expenses and payments:

Peter, single is a resident for tax purpose. He does not have any private hospital insurance.

Related Book For

Financial Accounting an introduction to concepts, methods and uses

ISBN: 978-0324789003

13th Edition

Authors: Clyde P. Stickney, Roman L. Weil, Katherine Schipper, Jennifer Francis

Posted Date: