Question: For This Discussion The main inventory methods include first-on first-out (FIFO), last-in last-out (LIFO), and the average cost. Explain which of the three methods

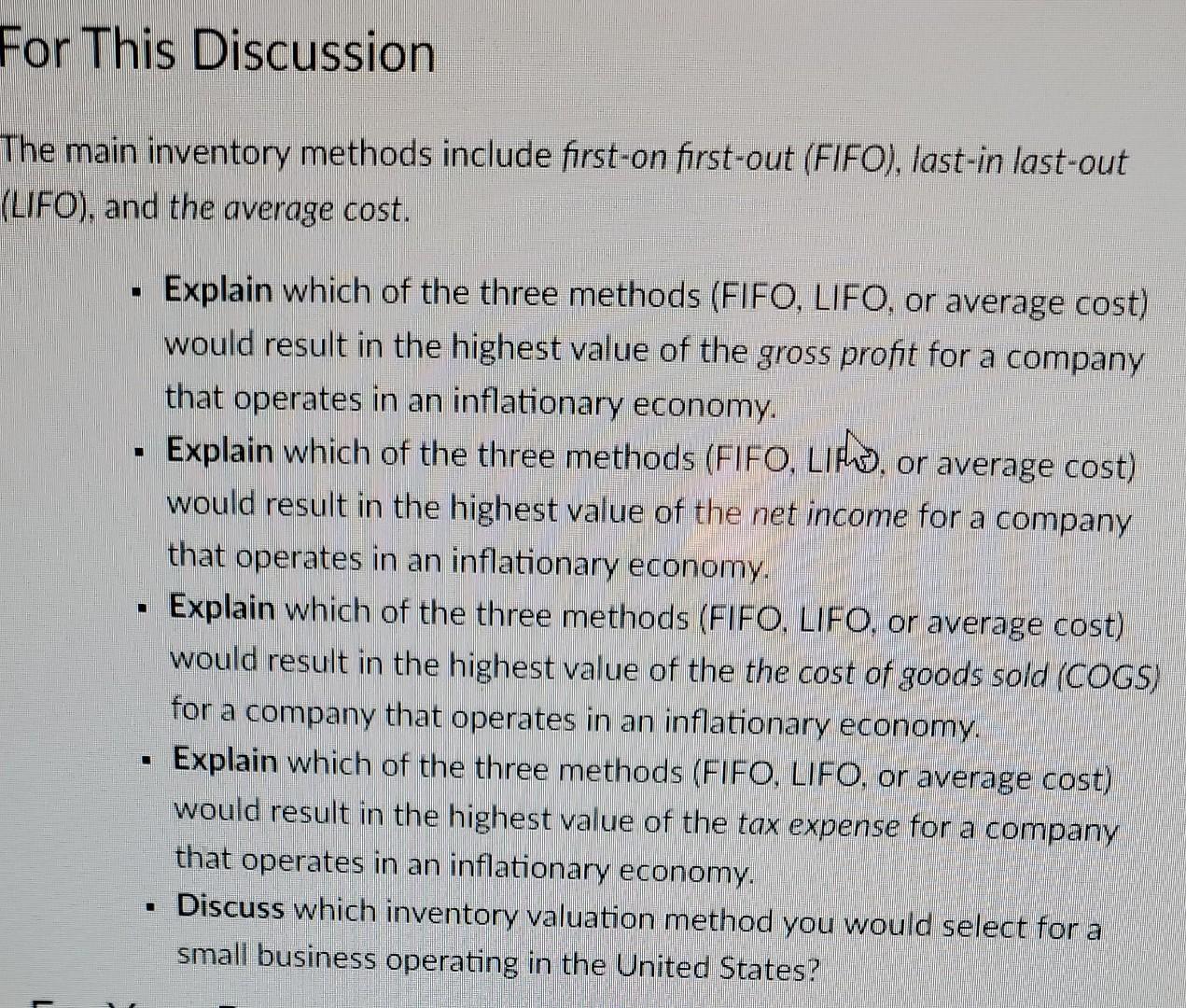

For This Discussion The main inventory methods include first-on first-out (FIFO), last-in last-out (LIFO), and the average cost. Explain which of the three methods (FIFO, LIFO, or average cost) would result in the highest value of the gross profit for a company that operates in an inflationary economy. Explain which of the three methods (FIFO, LIMO, or average cost) would result in the highest value of the net income for a company that operates in an inflationary economy. Explain which of the three methods (FIFO, LIFO, or average cost) would result in the highest value of the the cost of goods sold (COGS) for a company that operates in an inflationary economy. Explain which of the three methods (FIFO, LIFO, or average cost) would result in the highest value of the tax expense for a company that operates in an inflationary economy. Discuss which inventory valuation method you would select for a small business operating in the United States?

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Answer First in first out method Under FIFO the costs inventoried are the first costs transferred to ... View full answer

Get step-by-step solutions from verified subject matter experts