Question: For this problem please use data from finance.yahoo.com website . Pick your company from the list below and answer the following questions: a) Based on

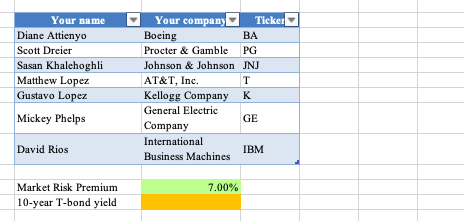

For this problem please use data from finance.yahoo.com website. Pick your company from the list below and answer the following questions:

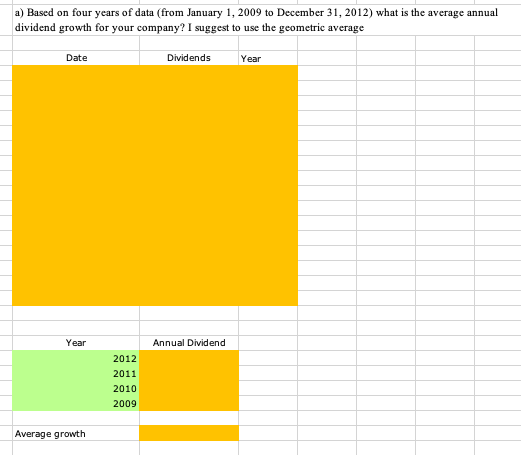

a) Based on four years of data (from January 1, 2009 to December 31, 2012) what is the average annual dividend growth for your company? I suggest using the geometric average

b) What is the expected cost of equity based on dividend growth model?

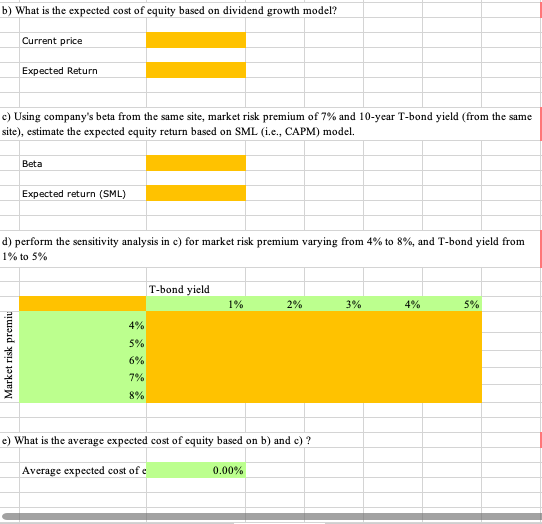

c) Using company's beta from the same site, market risk premium of 7% and 10-year T-bond yield (from the same website), estimate the expected cost of equity based on SML (i.e., CAPM) model.

d) perform the sensitivity analysis in c) for market equity risk premium varying from 4% to 8%, and T-bond yield from 1% to 5%

e) What is the average expected cost of equity based on b) and c) ?

Your name Diane Attienyo Scott Dreier Sasan Khalehoghli Matthew Lopez Gustavo Lopez Mickey Phelps Your company Ticker Boeing BA Procter & Gamble PG Johnson & Johnson JNJ AT&T, Inc. T Kellogg Company K General Electric GE Company International IBM Business Machines David Rios 7.00% Market Risk Premium 10-year T-bond yield a) Based on four years of data (from January 1, 2009 to December 31, 2012) what is the average annual dividend growth for your company? I suggest to use the geometric average Date Dividends Year Year Annual Dividend 2012 2011 2010 2009 Average growth b) What is the expected cost of equity based on dividend growth model? Current price Expected Return c) Using company's beta from the same site, market risk premium of 7% and 10-year T-bond yield (from the same site), estimate the expected equity return based on SML (i.e., CAPM) model. Beta Expected return (SML) d) perform the sensitivity analysis in c) for market risk premium varying from 4% to 8%, and T-bond yield from 1% to 5% T-bond yield 1% 2% 4% 5% Market risk premiu 4% 5% 6% 7% 8% e) What is the average expected cost of equity based on b) and c)? Average expected cost of c 0.00% Your name Diane Attienyo Scott Dreier Sasan Khalehoghli Matthew Lopez Gustavo Lopez Mickey Phelps Your company Ticker Boeing BA Procter & Gamble PG Johnson & Johnson JNJ AT&T, Inc. T Kellogg Company K General Electric GE Company International IBM Business Machines David Rios 7.00% Market Risk Premium 10-year T-bond yield a) Based on four years of data (from January 1, 2009 to December 31, 2012) what is the average annual dividend growth for your company? I suggest to use the geometric average Date Dividends Year Year Annual Dividend 2012 2011 2010 2009 Average growth b) What is the expected cost of equity based on dividend growth model? Current price Expected Return c) Using company's beta from the same site, market risk premium of 7% and 10-year T-bond yield (from the same site), estimate the expected equity return based on SML (i.e., CAPM) model. Beta Expected return (SML) d) perform the sensitivity analysis in c) for market risk premium varying from 4% to 8%, and T-bond yield from 1% to 5% T-bond yield 1% 2% 4% 5% Market risk premiu 4% 5% 6% 7% 8% e) What is the average expected cost of equity based on b) and c)? Average expected cost of c 0.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts