Question: For this question, assume that: (a) DIY Chef triggered CMUVs anti-dilution protection by issuing an additional 100,000 shares of DIY Chef's Series A preferred stock

For this question, assume that: (a) DIY Chef triggered CMUVs anti-dilution protection by issuing an additional 100,000 shares of DIY Chef's Series A preferred stock for $0.10 per share; and, (b) CMUV then immediately converted all of its Series A preferred stock to common stock. How many shares of common stock is CMUV entitled to upon its conversion? 4,000,000 shares 4,100,000 shares 40,000,000 shares 80,000,000 shares

For this question, assume that: (a) DIY Chef triggered CMUVs anti-dilution protection by issuing an additional 100,000 shares of DIY Chef's Series A preferred stock for $0.10 per share; and, (b) CMUV then immediately converted all of its Series A preferred stock to common stock. How many shares of common stock is CMUV entitled to upon its conversion? 4,000,000 shares 4,100,000 shares 40,000,000 shares 80,000,000 shares

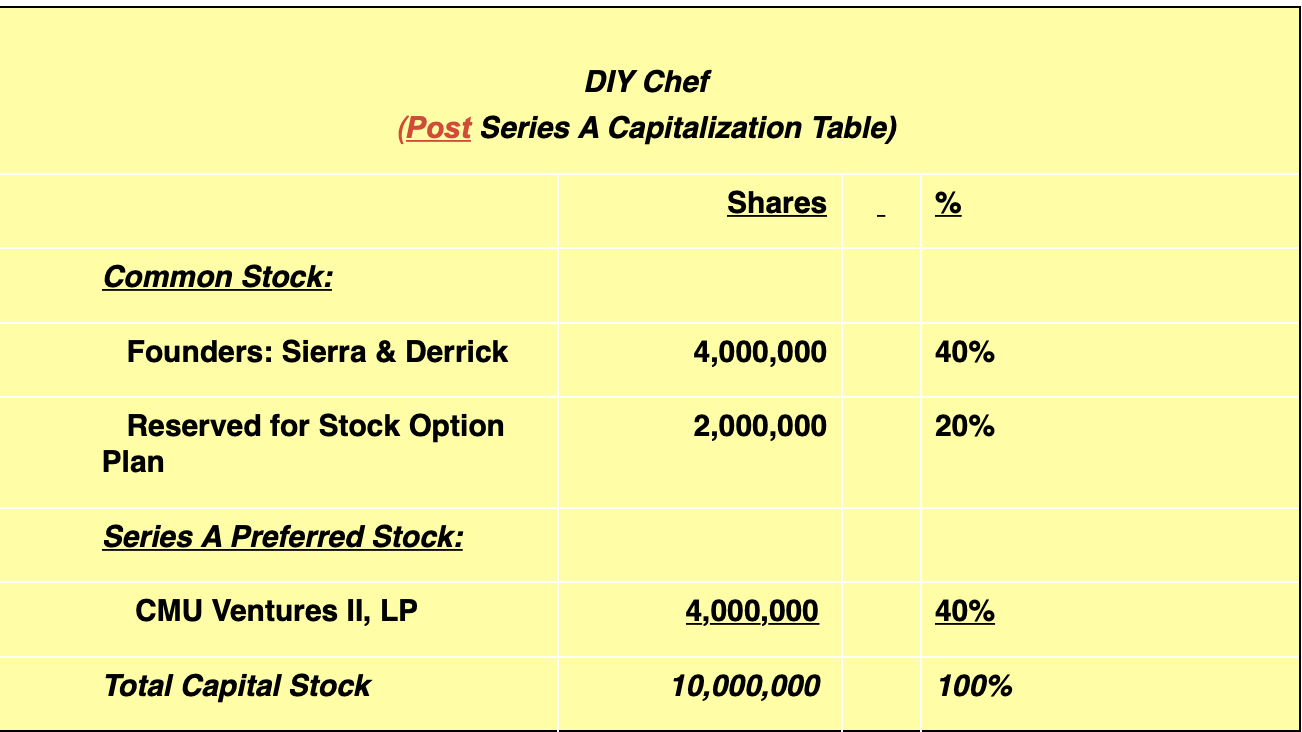

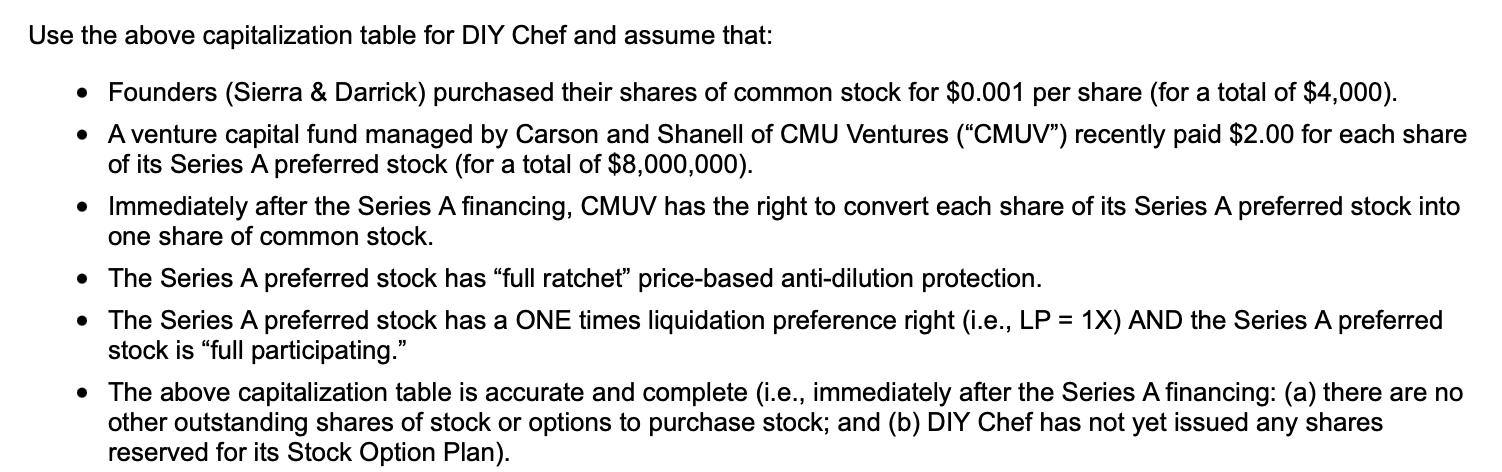

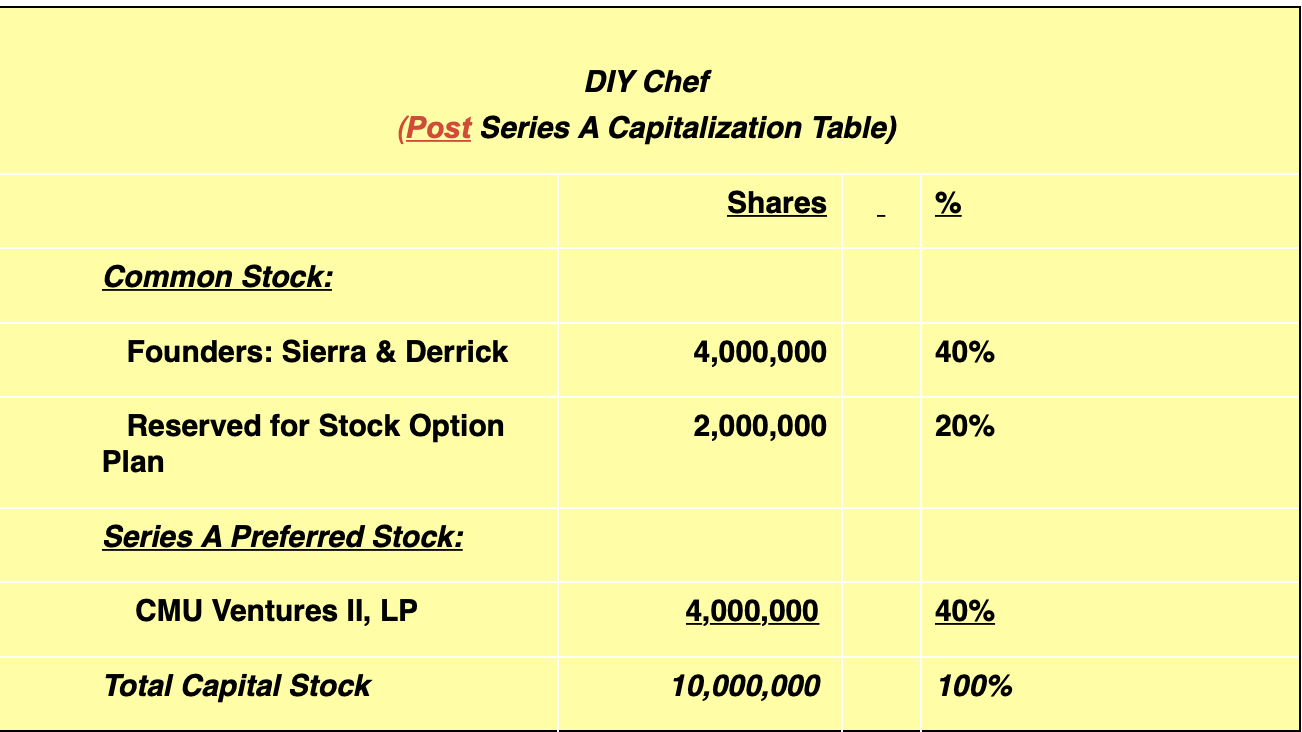

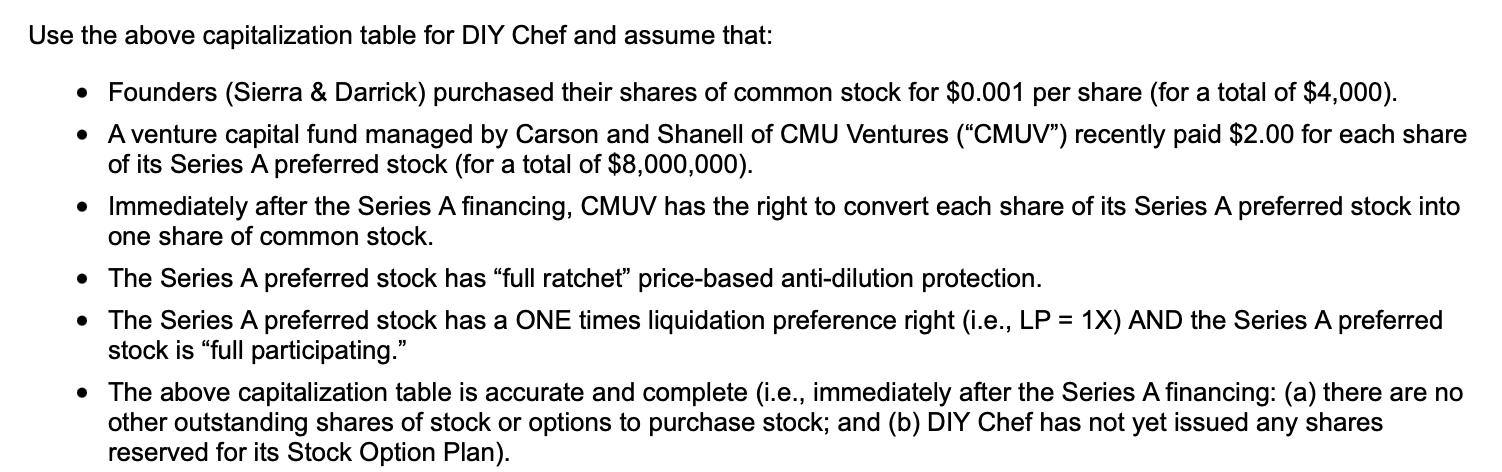

DIY Chef (Post Series A Capitalization Table) Shares % Common Stock: Founders: Sierra & Derrick 4,000,000 40% Reserved for Stock Option Plan 2,000,000 20% Series A Preferred Stock: CMU Ventures II, LP 4,000,000 40% Total Capital Stock 10,000,000 100% Use the above capitalization table for DIY Chef and assume that: Founders (Sierra & Darrick) purchased their shares of common stock for $0.001 per share (for a total of $4,000). A venture capital fund managed by Carson and Shanell of CMU Ventures ("CMUV") recently paid $2.00 for each share of its Series A preferred stock (for a total of $8,000,000). Immediately after the Series A financing, CMUV has the right to convert each share of its Series A preferred stock into one share of common stock. The Series A preferred stock has full ratchet" price-based anti-dilution protection. The Series A preferred stock has a ONE times liquidation preference right (i.e., LP = 1X) AND the Series A preferred stock is full participating. The above capitalization table is accurate and complete (i.e., immediately after the Series A financing: (a) there are no other outstanding shares of stock or options to purchase stock; and (b) DIY Chef has not yet issued any shares reserved for its Stock Option Plan). DIY Chef (Post Series A Capitalization Table) Shares % Common Stock: Founders: Sierra & Derrick 4,000,000 40% Reserved for Stock Option Plan 2,000,000 20% Series A Preferred Stock: CMU Ventures II, LP 4,000,000 40% Total Capital Stock 10,000,000 100% Use the above capitalization table for DIY Chef and assume that: Founders (Sierra & Darrick) purchased their shares of common stock for $0.001 per share (for a total of $4,000). A venture capital fund managed by Carson and Shanell of CMU Ventures ("CMUV") recently paid $2.00 for each share of its Series A preferred stock (for a total of $8,000,000). Immediately after the Series A financing, CMUV has the right to convert each share of its Series A preferred stock into one share of common stock. The Series A preferred stock has full ratchet" price-based anti-dilution protection. The Series A preferred stock has a ONE times liquidation preference right (i.e., LP = 1X) AND the Series A preferred stock is full participating. The above capitalization table is accurate and complete (i.e., immediately after the Series A financing: (a) there are no other outstanding shares of stock or options to purchase stock; and (b) DIY Chef has not yet issued any shares reserved for its Stock Option Plan)

For this question, assume that: (a) DIY Chef triggered CMUVs anti-dilution protection by issuing an additional 100,000 shares of DIY Chef's Series A preferred stock for $0.10 per share; and, (b) CMUV then immediately converted all of its Series A preferred stock to common stock. How many shares of common stock is CMUV entitled to upon its conversion? 4,000,000 shares 4,100,000 shares 40,000,000 shares 80,000,000 shares

For this question, assume that: (a) DIY Chef triggered CMUVs anti-dilution protection by issuing an additional 100,000 shares of DIY Chef's Series A preferred stock for $0.10 per share; and, (b) CMUV then immediately converted all of its Series A preferred stock to common stock. How many shares of common stock is CMUV entitled to upon its conversion? 4,000,000 shares 4,100,000 shares 40,000,000 shares 80,000,000 shares