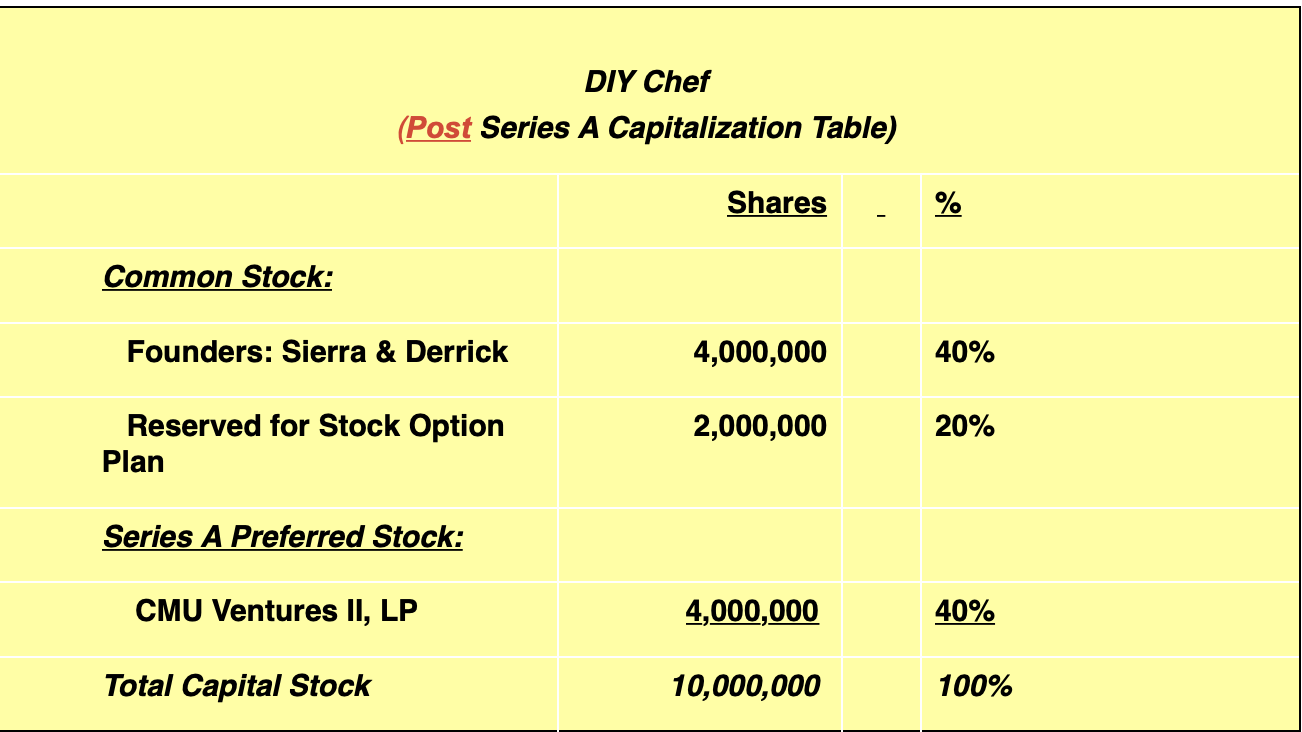

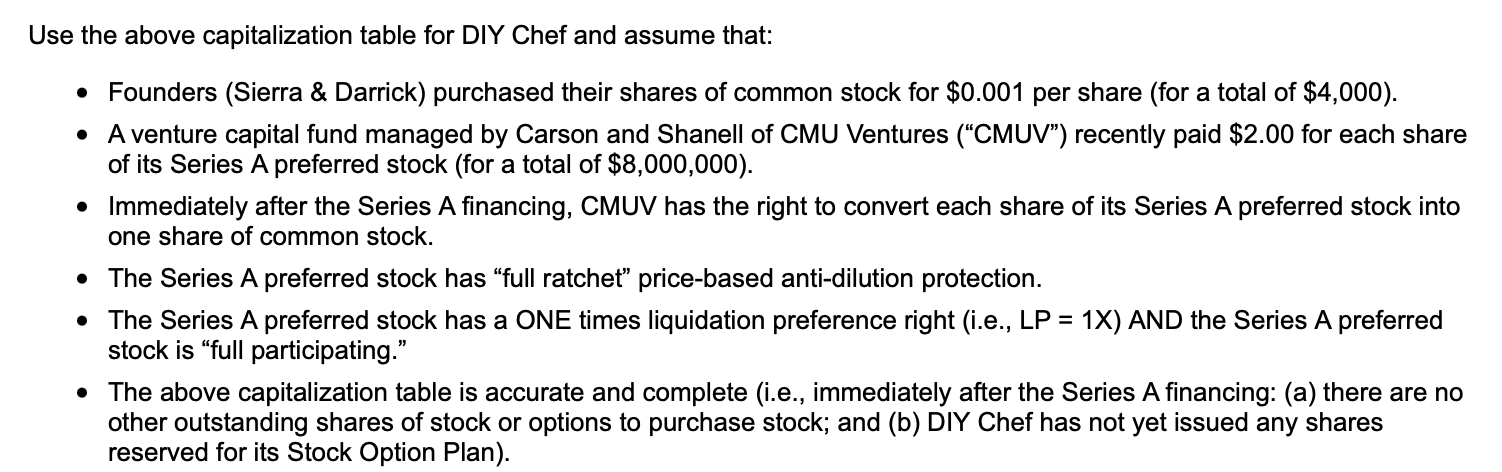

Question: QUESTION 23 For this question, assume that: (a) DIY Chef triggered CMUVs anti-dilution protection by issuing an additional 100,000 shares of DIY Chef's Series A

QUESTION 23

For this question, assume that: (a) DIY Chef triggered CMUVs anti-dilution protection by issuing an additional 100,000 shares of DIY Chef's Series A preferred stock for $0.10 per share; and, (b) CMUV then immediately converted all of its Series A preferred stock to common stock.

How many shares of common stock is CMUV entitled to upon its conversion?

| 4,000,000 shares | ||

| 4,100,000 shares | ||

| 40,000,000 shares | ||

| 80,000,000 shares |

QUESTION 24

Considering your response to the previous question. The Founders percentage ownership interest in DIY Chef:

| Will decrease (i.e., the founders will now own less than 40%) | ||

| Will stay the same (i.e., the founders will still own 40%) | ||

| Will increase (i.e., the founders will own more than 40%) |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts