Question: Format in excel Problem 8-4A Computing and revising depreciation; revenue and capital expenditures Oc1 C2 E c3 Champion Contractors completed the following transactions involving equipment.

Format in excel

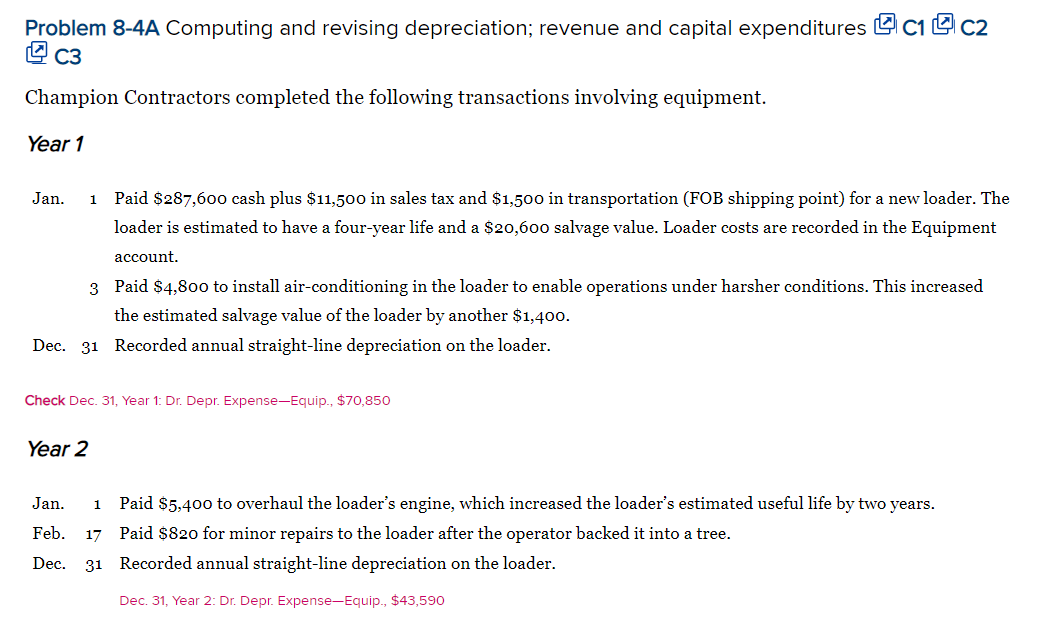

Problem 8-4A Computing and revising depreciation; revenue and capital expenditures Oc1 C2 E c3 Champion Contractors completed the following transactions involving equipment. Year 1 1 Jan. Paid $287,600 cash plus $11,500 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $20,600 salvage value. Loader costs are recorded in the Equipment account. 3 Paid $4,800 to install air-conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,400. Dec. 31 Recorded annual straight-line depreciation on the loader. Check Dec. 31, Year 1: Dr. Depr. Expense-Equip., $70,850 Year 2 Jan. 1 Feb. Paid $5,400 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. 17 Paid $820 for minor repairs to the loader after the operator backed it into a tree. 31 Recorded annual straight-line depreciation on the loader. Dec. Dec. 31, Year 2: Dr. Depr. Expense-Equip., $43,590

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts