Question: Formular please if need F1 B fx Basic Income Statement Components & Assumptions B D E K L M N O P Q R S

Formular please if need

Formular please if need

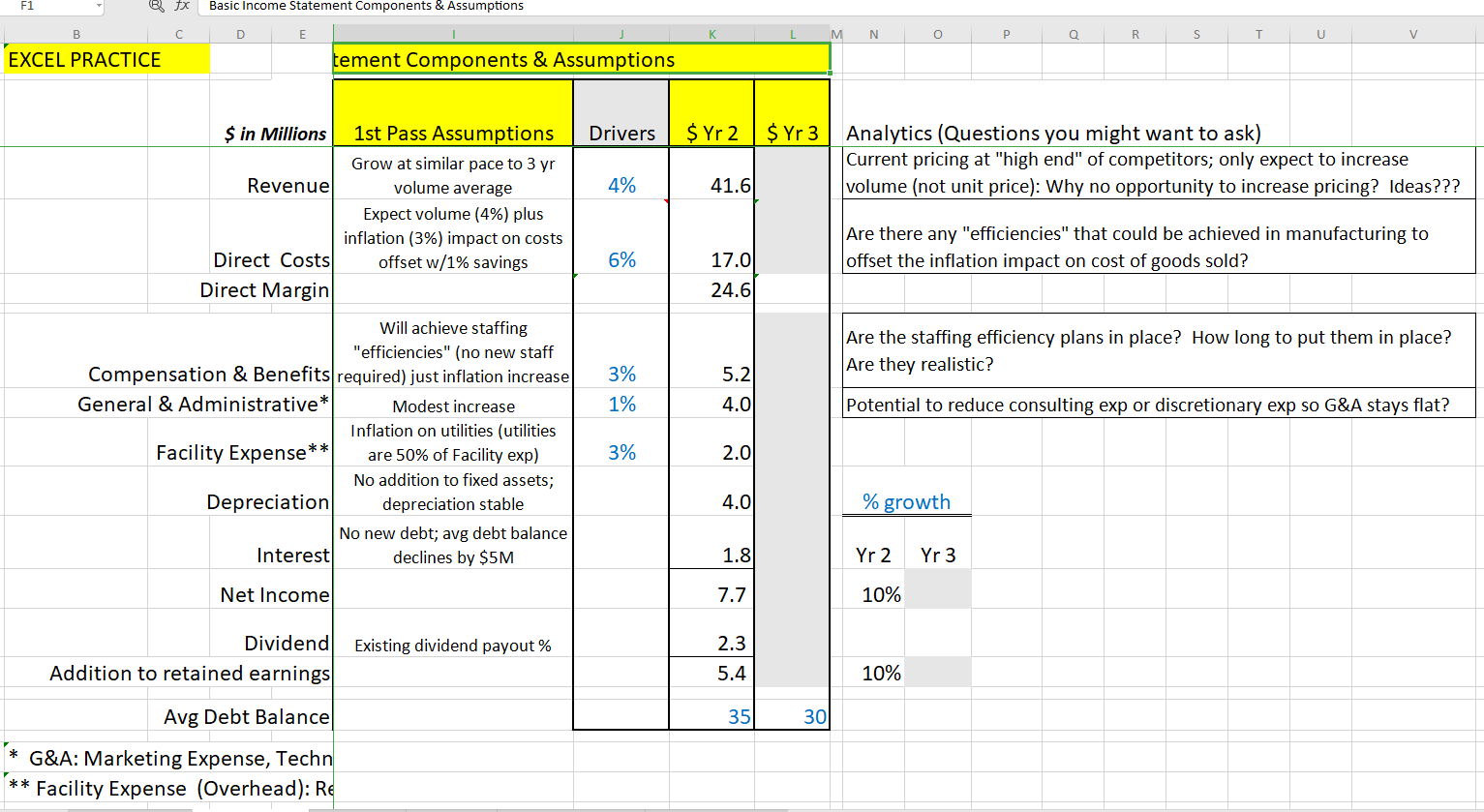

F1 B fx Basic Income Statement Components & Assumptions B D E K L M N O P Q R S U V EXCEL PRACTICE tement Components & Assumptions $ in Millions Drivers $ Yr 2 $ Yr 3 Analytics (Questions you might want to ask) Current pricing at "high end" of competitors; only expect to increase volume (not unit price): Why no opportunity to increase pricing? Ideas??? Revenue 4% 1st Pass Assumptions Grow at similar pace to 3 yr volume average Expect volume (4%) plus inflation (3%) impact on costs offset w/1% savings 41.6 Are there any "efficiencies" that could be achieved in manufacturing to offset the inflation impact on cost of goods sold? 6% Direct Costs Direct Margin 17.0 24.6 Are the staffing efficiency plans in place? How long to put them in place? Are they realistic? 3% 5.2 1% 4.0 Potential to reduce consulting exp or discretionary exp so G&A stays flat? Will achieve staffing "efficiencies" (no new staff Compensation & Benefits required) just inflation increase General & Administrative Modest increase Inflation on utilities (utilities Facility Expense ** are 50% of Facility exp) No addition to fixed assets; Depreciation depreciation stable No new debt; avg debt balance Interest declines by $5M 3% 2.0 4.0 % growth 1.8 Yr 2 Yr 3 Net Income 7.7 10% Existing dividend payout % 2.3 Dividend Addition to retained earnings 5.4 10% Avg Debt Balance 35 30 * G&A: Marketing Expense, Techn Facility Expense (Overhead): Re F1 B fx Basic Income Statement Components & Assumptions B D E K L M N O P Q R S U V EXCEL PRACTICE tement Components & Assumptions $ in Millions Drivers $ Yr 2 $ Yr 3 Analytics (Questions you might want to ask) Current pricing at "high end" of competitors; only expect to increase volume (not unit price): Why no opportunity to increase pricing? Ideas??? Revenue 4% 1st Pass Assumptions Grow at similar pace to 3 yr volume average Expect volume (4%) plus inflation (3%) impact on costs offset w/1% savings 41.6 Are there any "efficiencies" that could be achieved in manufacturing to offset the inflation impact on cost of goods sold? 6% Direct Costs Direct Margin 17.0 24.6 Are the staffing efficiency plans in place? How long to put them in place? Are they realistic? 3% 5.2 1% 4.0 Potential to reduce consulting exp or discretionary exp so G&A stays flat? Will achieve staffing "efficiencies" (no new staff Compensation & Benefits required) just inflation increase General & Administrative Modest increase Inflation on utilities (utilities Facility Expense ** are 50% of Facility exp) No addition to fixed assets; Depreciation depreciation stable No new debt; avg debt balance Interest declines by $5M 3% 2.0 4.0 % growth 1.8 Yr 2 Yr 3 Net Income 7.7 10% Existing dividend payout % 2.3 Dividend Addition to retained earnings 5.4 10% Avg Debt Balance 35 30 * G&A: Marketing Expense, Techn Facility Expense (Overhead): Re

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts