Question: formulas in symbols with work for each step written out(without using excel if possible) and a short summary at the end of the problem. thank

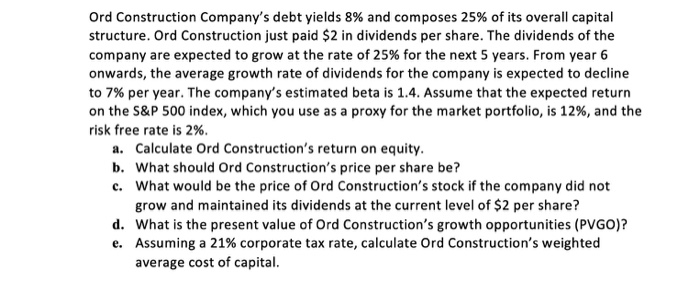

Ord Construction Company's debt yields 8% and composes 25% of its overall capital structure. Ord Construction just paid $2 in dividends per share. The dividends of the company are expected to grow at the rate of 25% for the next 5 years. From year 6 onwards, the average growth rate of dividends for the company is expected to decline to 7% per year. The company's estimated beta is 1.4. Assume that the expected return on the S&P 500 index, which you use as a proxy for the market portfolio, is 12%, and the risk free rate is 2%. a. Calculate Ord Construction's return on equity. b. What should Ord Construction's price per share be? c. What would be the price of Ord Construction's stock if the company did not grow and maintained its dividends at the current level of $2 per share? d. What is the present value of Ord Construction's growth opportunities (PVGO)? e. Assuming a 21% corporate tax rate, calculate Ord Construction's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts