Question: formulas in symbols with work for each step written out(without using excel if possible) and a short summary at the end of the problem. thank

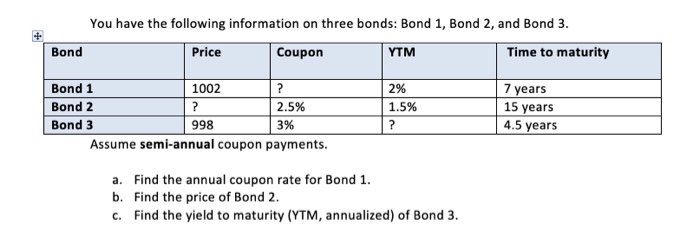

You have the following information on three bonds: Bond 1, Bond 2, and Bond 3. Bond Price Coupon YTM Time to maturity Bond 1 1002 ? Bond 2 ? 2.5% Bond 3 998 3% Assume semi-annual coupon payments. 2% 1.5% ? 7 years 15 years 4.5 years a. Find the annual coupon rate for Bond 1. b. Find the price of Bond 2. c. Find the yield to maturity (YTM, annualized) of Bond 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts