Question: formulas in symbols with work for each step written out(without using excel if possible) and a short summary at the end of the problem. thank

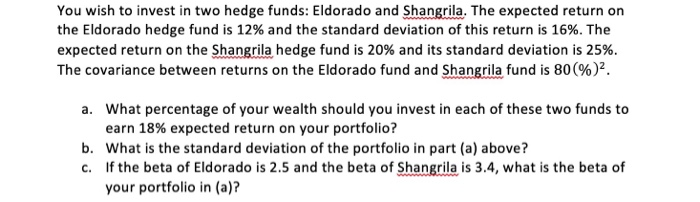

You wish to invest in two hedge funds: Eldorado and Shangrila. The expected return on the Eldorado hedge fund is 12% and the standard deviation of this return is 16%. The expected return on the Shangrila hedge fund is 20% and its standard deviation is 25%. The covariance between returns on the Eldorado fund and Shangrila fund is 80%). a. What percentage of your wealth should you invest in each of these two funds to earn 18% expected return on your portfolio? b. What is the standard deviation of the portfolio in part (a) above? c. If the beta of Eldorado is 2.5 and the beta of Shangrila is 3.4, what is the beta of your portfolio in (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts