Question: Four times the past two years' average gross margin: b. The present value of the average of the past three years' cash flows discounted at

Four times the past two years' average gross margin:

b. The present value of the average of the past three years' cash flows discounted at 8% for the next 10 years. Estimate of cash flow from operations for the three years. Then discount the average of this amount at 8% for 10 years to determine the hotel's implied value.

c. Combine the values calculated in a) and b) using the weights provided. What is the appraised value of the Bed and Breakfast? Assume the appraised value is the total amount that the bank will loan Ms. rose unless Ms. Warren either pays 25% of the purchase in cash or pledges to the bank a first priority lien on the vacant land as collateral. If Ms. Rose has $500,000 available as a down payment, could she have borrowed enough money based on this appraisal without pledging the vacant land as collateral?

Should Peterson Accounting have relied on the income statement and footnote information provided by Ms. Martinez's accountant? Why or why not?

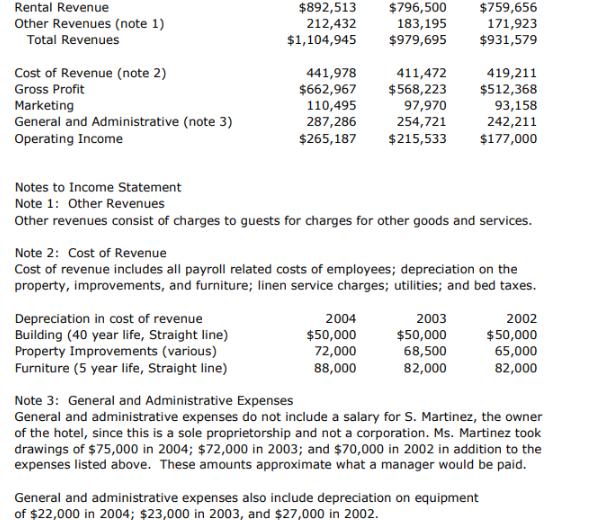

Rental Revenue Other Revenues (note 1) Total Revenues Cost of Revenue (note 2) Gross Profit Marketing General and Administrative (note 3) Operating Income $892,513 212,432 $1,104,945 441,978 $662,967 110,495 287,286 $265,187 Depreciation in cost of revenue Building (40 year life, Straight line) Property Improvements (various) Furniture (5 year life, Straight line) $796,500 $759,656 183,195 171,923 $979,695 $931,579 411,472 419,211 $568,223 $512,368 93,158 242,211 $177,000 Notes to Income Statement Note 1: Other Revenues Other revenues consist of charges to guests for charges for other goods and services. 2004 $50,000 72,000 88,000 97,970 254,721 $215,533 Note 2: Cost of Revenue Cost of revenue includes all payroll related costs of employees; depreciation on the property, improvements, and furniture; linen service charges; utilities; and bed taxes. 2003 $50,000 68,500 82,000 2002 $50,000 65,000 82,000 Note 3: General and Administrative Expenses General and administrative expenses do not include a salary for S. Martinez, the owner of the hotel, since this is a sole proprietorship and not a corporation. Ms. Martinez took drawings of $75,000 in 2004; $72,000 in 2003; and $70,000 in 2002 in addition to the expenses listed above. These amounts approximate what a manager would be paid. General and administrative expenses also include depreciation on equipment of $22,000 in 2004; $23,000 in 2003, and $27,000 in 2002.

Step by Step Solution

3.58 Rating (159 Votes )

There are 3 Steps involved in it

Here are the stepbystep workings a Four times the past two years average gross margin Gross margin i... View full answer

Get step-by-step solutions from verified subject matter experts