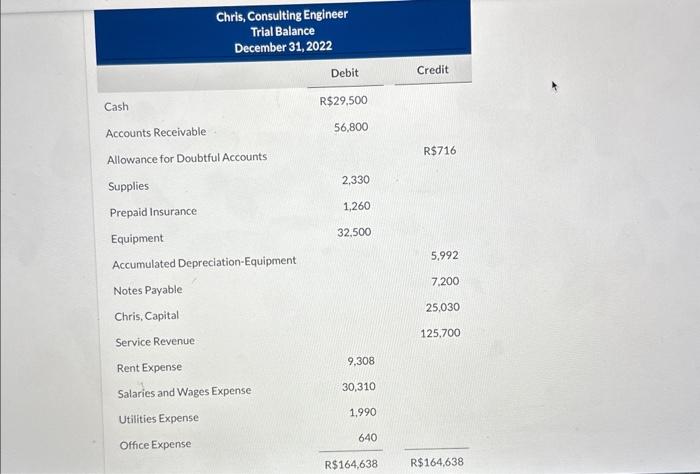

Question: full answer for that please Chris, Consulting Engineer Trial Balance December 31, 2022 Cash begin{tabular}{r} multicolumn{1}{c}{ Debit } hlineR$29,500 56,800 2,330

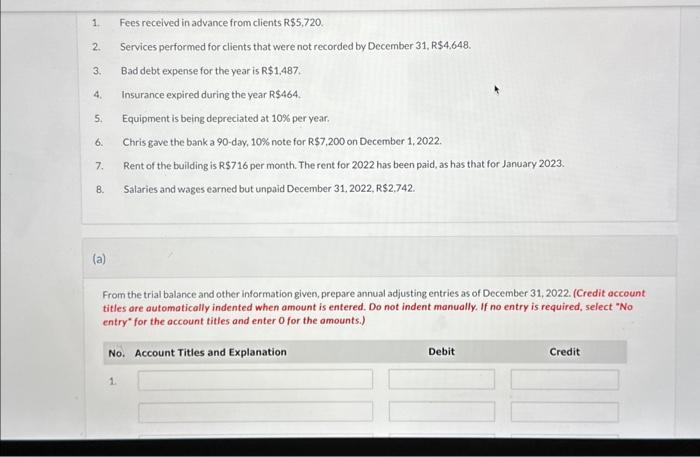

Chris, Consulting Engineer Trial Balance December 31, 2022 Cash \begin{tabular}{r} \multicolumn{1}{c}{ Debit } \\ \hlineR$29,500 \\ 56,800 \\ 2,330 \\ 1,260 \\ 32,500 \end{tabular} Equipment R$716 Allowance for Doubtful Accounts Supplies Prepaid Insurance Credit Accounts Receivable Accumulated Depreciation-Equipment Notes Payable Chris, Capital Service Revenue 5.992 Rent Expense 7.200 25,030 Salaries and Wages Expense 30,310 Utilities Expense 1,990 125,700 Office Expense R$164,638640R$164,638 1. Fees received in advance from clients R$5,720. 2. Services performed for clients that were not recorded by December 31, R\$4,648. 3. Bad debt expense for the year is R$1,487. 4. Insurance expired during the vear R\$464. 5. Equipment is being depreciated at 10% per year. 6. Chris gave the bank a 90 -day, 10% note for R $7,200 on December 1,2022. 7. Rent of the building is R $716 per month. The rent for 2022 has been paid, as has that for January 2023. 8. Salaries and wages earned but unpaid December 31, 2022, R\$2,742. (a) From the trial balance and other information given, prepare annual adjusting entries as of December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry for the account titles and enter ofor the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts