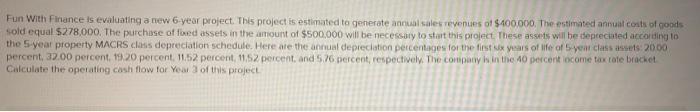

Question: Fun With Finance is evaluating a new 6 year project. This project is estimated to generate annual sales revenues of $400.000. The estimated annuat costs

Fun With Finance is evaluating a new 6 year project. This project is estimated to generate annual sales revenues of $400.000. The estimated annuat costs of goods sold equal $278.000. The purchase of foued assets in the amount of $500,000 will be necessary to start this project. These assets will be depreciated according to the 5-year property MACRS class depreciation schedule. Here are the annual depreciation percentages for the first years of life of 5-year class asses:2000 percent, 22.00 percent 1920 percent. 11.52 percent. 11.52 percent and 576 percent, respectively. The company has in the percent ocome tax tote bracket Calculate the operating cash flow for Year of this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts