Question: Fun With Finance is evaluating a new 6-year project. This project is estimated to generate annual sales revenues of $455,000. The estimated annual costs of

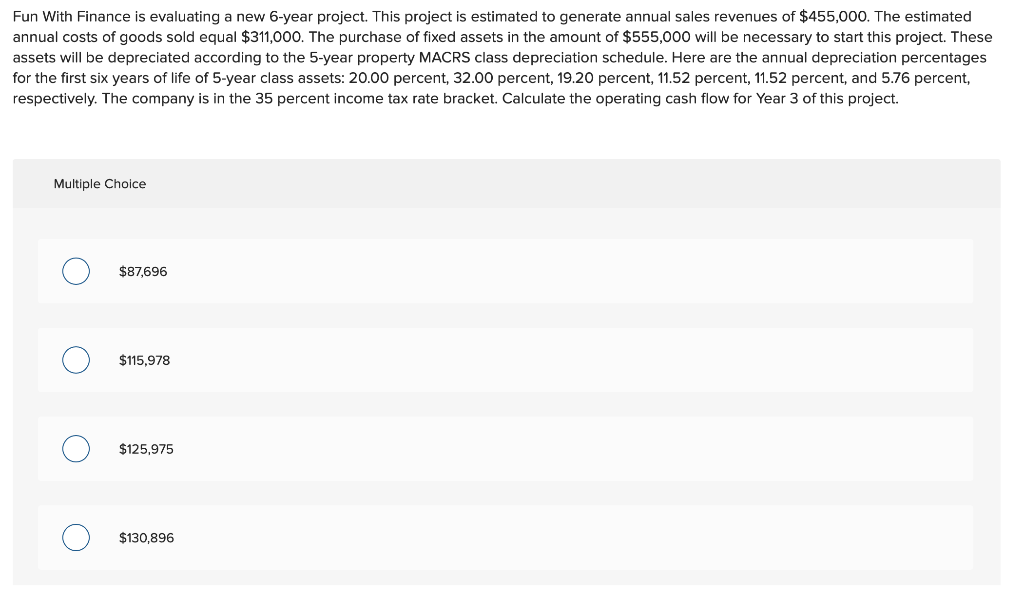

Fun With Finance is evaluating a new 6-year project. This project is estimated to generate annual sales revenues of $455,000. The estimated annual costs of goods sold equal $311,000. The purchase of fixed assets in the amount of $555,000 will be necessary to start this project. These assets will be depreciated according to the 5-year property MACRS class depreciation schedule. Here are the annual depreciation percentages for the first six years of life of 5-year class assets: 20.00 percent, 32.00 percent, 19.20 percent, 11.52 percent, 11.52 percent, and 5.76 percent, respectively. The company is in the 35 percent income tax rate bracket. Calculate the operating cash flow for Year 3 of this project. Multiple Choice $87,696 O $115,978 $125,975 O O $130,896

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts