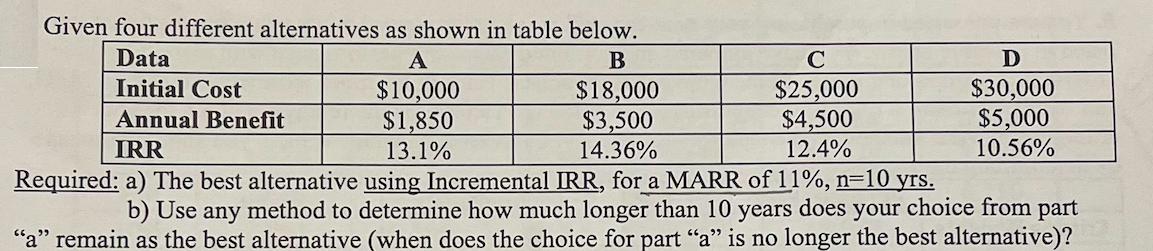

Question: Given four different alternatives as shown in table below. Data C $30,000 $5,000 10.56% Initial Cost $10,000 $1,850 13.1% $18,000 $3,500 14.36% $25,000 $4,500

Given four different alternatives as shown in table below. Data C $30,000 $5,000 10.56% Initial Cost $10,000 $1,850 13.1% $18,000 $3,500 14.36% $25,000 $4,500 12.4% Annual Benefit IRR Required: a) The best alternative using Incremental IRR, for a MARR of 11%, n=10 yrs. b) Use any method to determine how much longer than 10 years does your choice from part "a" remain as the best alternative (when does the choice for part "a" is no longer the best alternative)?

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step 1 iBefore investing in new projects or assets profitability is evaluated by us... View full answer

Get step-by-step solutions from verified subject matter experts