Question: Given that answers, what are the solutions how it get? provide the solution I need it ASAP, just a simple solution is okay, no need

Given that answers, what are the solutions how it get?

provide the solution

I need it ASAP, just a simple solution is okay, no need a lot of explanation

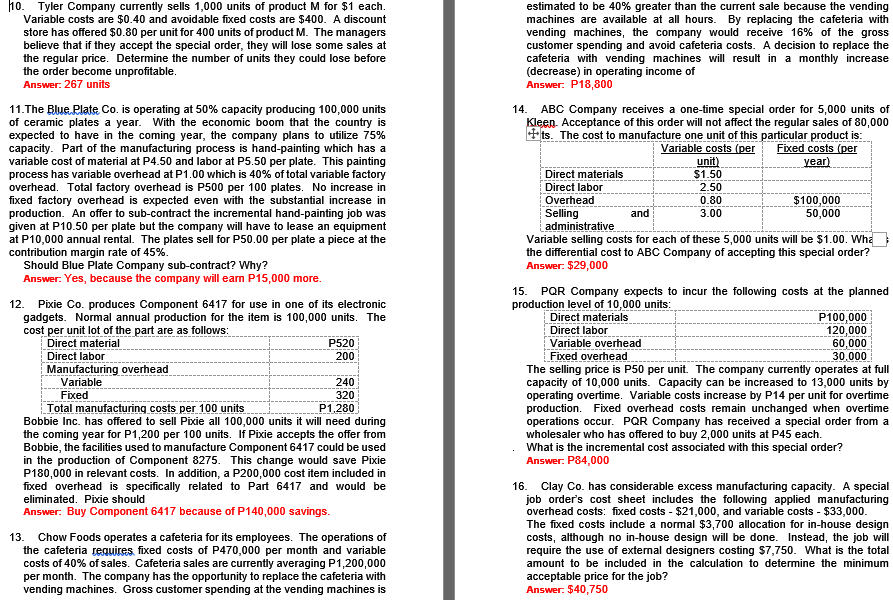

10. Tyler Company currently sells 1,000 units of product M for $1 each. Variable costs are $0.40 and avoidable fixed costs are $400. A discount store has offered $0.80 per unit for 400 units of product M. The managers believe that if they accept the special order, they will lose some sales at the regular price. Determine the number of units they could lose before the order become unprofitable. Answer: 267 units 11.The Blue Plate Co. is operating at 50% capacity producing 100,000 units of ceramic plates a year. With the economic boom that the country is expected to have in the coming year, the company plans to utilize 75% capacity. Part of the manufacturing process is hand-painting which has a variable cost of material at P4.50 and labor at P5.50 per plate. This painting process has variable overhead at P1.00 which is 40% of total variable factory overhead. Total factory overhead is P500 per 100 plates. No increase in fixed factory overhead is expected even with the substantial increase in production. An offer to sub-contract the incremental hand-painting job was given at P10.50 per plate but the company will have to lease an equipment at P10,000 annual rental. The plates sell for P50.00 per plate a piece at the contribution margin rate of 45%. Should Blue Plate Company sub-contract? Why? Answer: Yes, because the company will earn P15,000 more. 12. Pixie Co. produces Component 6417 for use in one of its electronic gadgets. Normal annual production for the item is 100,000 units. The cost per unit lot of the part are as follows: Direct material Direct labor Manufacturing overhead Variable Fixed Total manufacturing costs per 100 units P520 200 240 320 P1,280 Bobbie Inc. has offered to sell Pixie all 100,000 units it will need during the coming year for P1,200 per 100 units. If Pixie accepts the offer from Bobbie, the facilities used to manufacture Component 6417 could be used in the production of Component 8275. This change would save Pixie P180,000 in relevant costs. In addition, a P200,000 cost item included in fixed overhead is specifically related to Part 6417 and would be eliminated. Pixie should Answer: Buy Component 6417 because of P140,000 savings. 13. Chow Foods operates a cafeteria for its employees. The operations of the cafeteria requires fixed costs of P470,000 per month and variable costs of 40% of sales. Cafeteria sales are currently averaging P1,200,000 per month. The company has the opportunity to replace the cafeteria with vending machines. Gross customer spending at the vending machines is 14. estimated to be 40% greater than the current sale because the vending machines are available at all hours. By replacing the cafeteria with vending machines, the company would receive 16% of the gross customer spending and avoid cafeteria costs. A decision to replace the cafeteria with vending machines will result in a monthly increase (decrease) in operating income of Answer: P18,800 ABC Company receives a one-time special order for 5,000 units of Kleen. Acceptance of this order will not affect the regular sales of 80,000 +ts. The cost to manufacture one unit of this particular product is: Variable costs (per Fixed costs (per Direct materials Direct labor Overhead Selling and administrative unit) $1.50 2.50 0.80 3.00 year) $100,000 50,000 Variable selling costs for each of these 5,000 units will be $1.00. Wha the differential cost to ABC Company of accepting this special order? Answer: $29,000 15. PQR Company expects to incur the following costs at the planned production level of 10,000 units: Direct materials Direct labor Variable overhead Fixed overhead P100,000 120,000 60,000 30.000 The selling price is P50 per unit. The company currently operates at full capacity of 10,000 units. Capacity can be increased to 13,000 units by operating overtime. Variable costs increase by P14 per unit for overtime production. Fixed overhead costs remain unchanged when overtime operations occur. PQR Company has received a special order from a wholesaler who has offered to buy 2,000 units at P45 each. What is the incremental cost associated with this special order? Answer: P84,000 16. Clay Co. has considerable excess manufacturing capacity. A special job order's cost sheet includes the following applied manufacturing overhead costs: fixed costs - $21,000, and variable costs - $33,000. The fixed costs include a normal $3,700 allocation for in-house design costs, although no in-house design will be done. Instead, the job will require the use of external designers costing $7,750. What is the total amount to be included in the calculation to determine the minimum acceptable price for the job? Answer: $40,750

Step by Step Solution

There are 3 Steps involved in it

To solve each scenario from the given text lets break down the solutions stepbystep Problem 10 Tyler Company Regular Sales 1000 units at 1 1000 Variab... View full answer

Get step-by-step solutions from verified subject matter experts