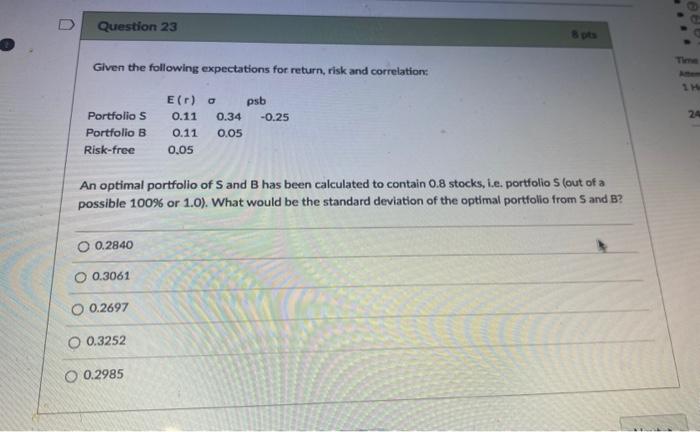

Question: Given the following expectations for return, risk and correlations: An optimal portfolio of S and B has been calculated to contain 0.8 stocks, i.e. portfolio

Given the following expectations for return, risk and correlations: An optimal portfolio of S and B has been calculated to contain 0.8 stocks, i.e. portfolio S (out of a possible 100% or 1.0). What would be the standard deviation of the optimal portfolio from S and B ? \begin{tabular}{l} 0.2840 \\ 0.3061 \\ 0.2697 \\ 0.3252 \\ \hline 0.2985 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts