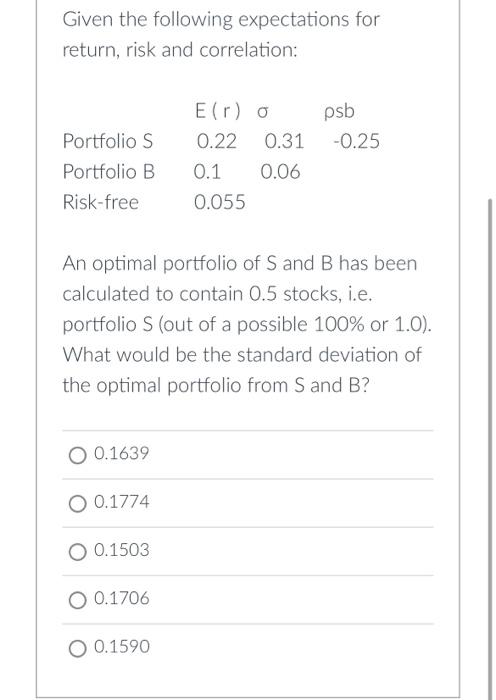

Question: please answer both Given the following expectations for return, risk and correlation: An optimal portfolio of S and B has been calculated to contain 0.5

Given the following expectations for return, risk and correlation: An optimal portfolio of S and B has been calculated to contain 0.5 stocks, i.e. portfolio S (out of a possible 100% or 1.0). What would be the standard deviation of the optimal portfolio from S and B ? \begin{tabular}{l} 0.1639 \\ 0.1774 \\ \hline 0.1503 \\ 0.1706 \\ \hline 0.1590 \end{tabular} Firm-specific risk is also known as: economic risk diversifiable risk non-diversifiable risk market risk systematic risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts