Question: Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax

Given the following tax structure, what minimum tax would need to be assessed on Shameika to make the tax progressive with respect to average tax rates?

Taxpayer Salary MuniBond Interest Total Tax

Mihwah $ $ $

Shameika $ $

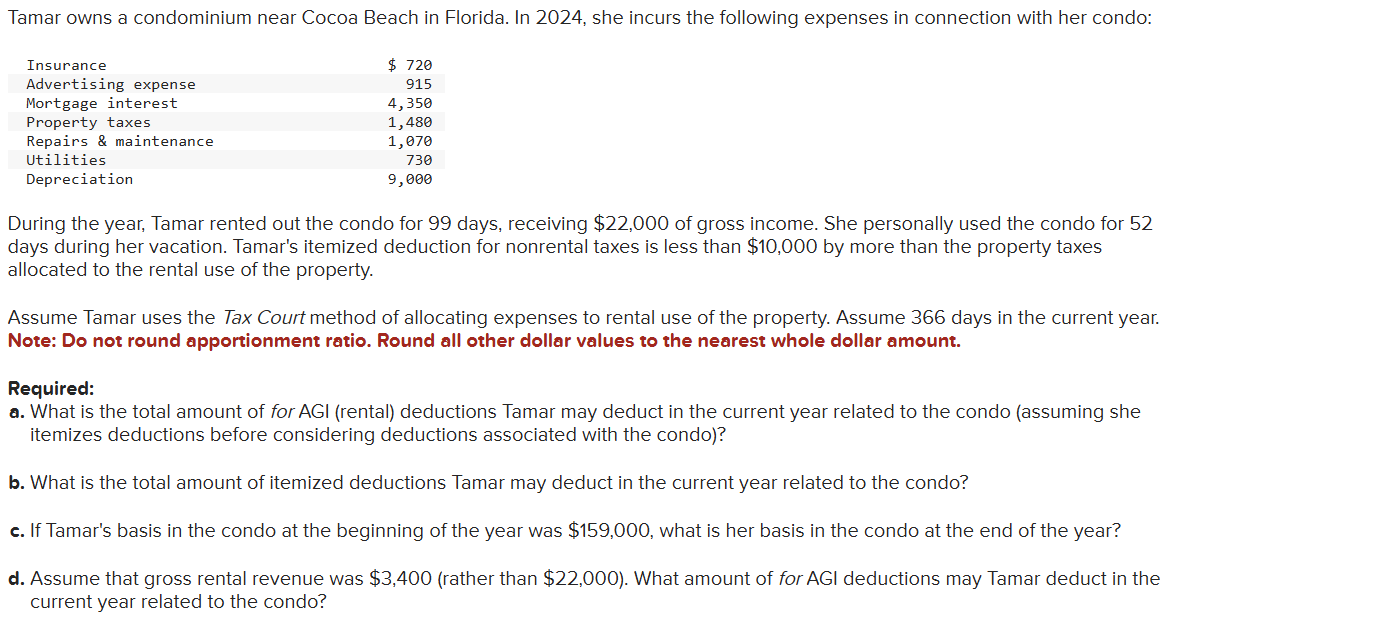

d For AGI deductions Tamar owns a condominium near Cocoa Beach in Florida. In she incurs the following expenses in connection with her condo:

During the year, Tamar rented out the condo for days, receiving $ of gross income. She personally used the condo for days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $ by more than the property taxes allocated to the rental use of the property.

Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume days in the current year.

Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount.

Required:

a What is the total amount of for AGI rental deductions Tamar may deduct in the current year related to the condo assuming she itemizes deductions before considering deductions associated with the condo

b What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo?

c If Tamar's basis in the condo at the beginning of the year was $ what is her basis in the condo at the end of the year?

d Assume that gross rental revenue was $ rather than $ What amount of for AGI deductions may Tamar deduct in the current year related to the condo?

d For AGI deductions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock