Question: given the table above, please answer Question 9 8) Numerical application for the bonds defined in question 6 above. An investor considers putting 1,000,000$ in

given the table above, please answer Question 9

given the table above, please answer Question 9

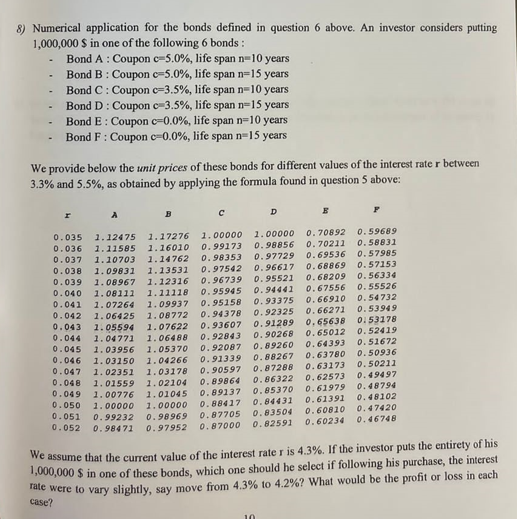

8) Numerical application for the bonds defined in question 6 above. An investor considers putting 1,000,000$ in one of the following 6 bonds : - Bond A : Coupon c=5.0%, life span n=10 years - Bond B : Coupon c=5.0%, life span n=15 years - Bond C : Coupon c=3.5%, life span n=10 years - Bond D : Coupon c3.5%, life span n=15 years - Bond E : Coupon c=0.0%, life span n=10 years - Bond F : Coupon c=0.0%, life spann=15 years We provide below the unit prices of these bonds for different values of the interest rate r between 3.3% and 5.5%, as obtained by applying the formula found in question 5 above: We assume that the current value of the interest rate r is 4.3%. If the investor puts the entirety of his 1,000,000$ in one of these bonds, which one should he select if following his purchase, the interest rate were to vary slightly, say move from 4.3% to 4.2% ? What would be the profit or loss in each case? 9) In the previous table, consider that the interest rate can either go down from 4.3% to 4.2% or go up from 4.3% to 4.4%. What do you think would be the advantages or disadvantages of investing in bonds E or F instead of the other ones? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts