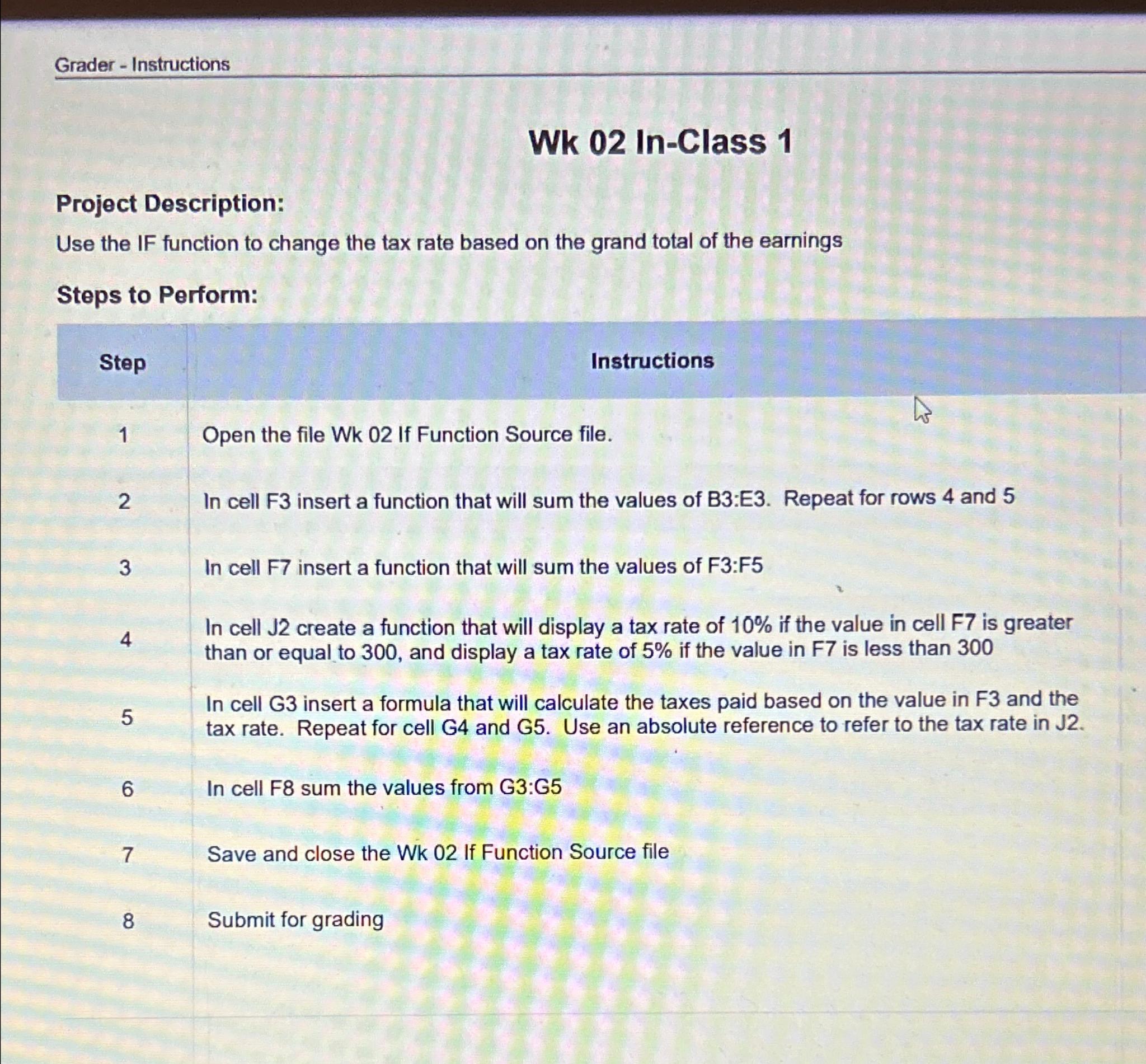

Question: Grader - Instructions Wk 0 2 In - Class 1 Project Description: Use the IF function to change the tax rate based on the grand

Grader Instructions

Wk InClass

Project Description:

Use the IF function to change the tax rate based on the grand total of the earnings

Steps to Perform:

Step

Instructions

Open the file Wk If Function Source file.

In cell F insert a function that will sum the values of B:E Repeat for rows and

In cell F insert a function that will sum the values of F:F

In cell J create a function that will display a tax rate of if the value in cell is greater than or equal to and display a tax rate of if the value in F is less than

In cell G insert a formula that will calculate the taxes paid based on the value in F and the tax rate. Repeat for cell G and G Use an absolute reference to refer to the tax rate in J

In cell F sum the values from G:G

Save and close the Wk If Function Source file

Submit for grading

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock