Question: Guidelines for Submission Submit the Project Workbook with the Cost Classification and Fixed and Variable Costs tabs completed. This file should be completed and submitted

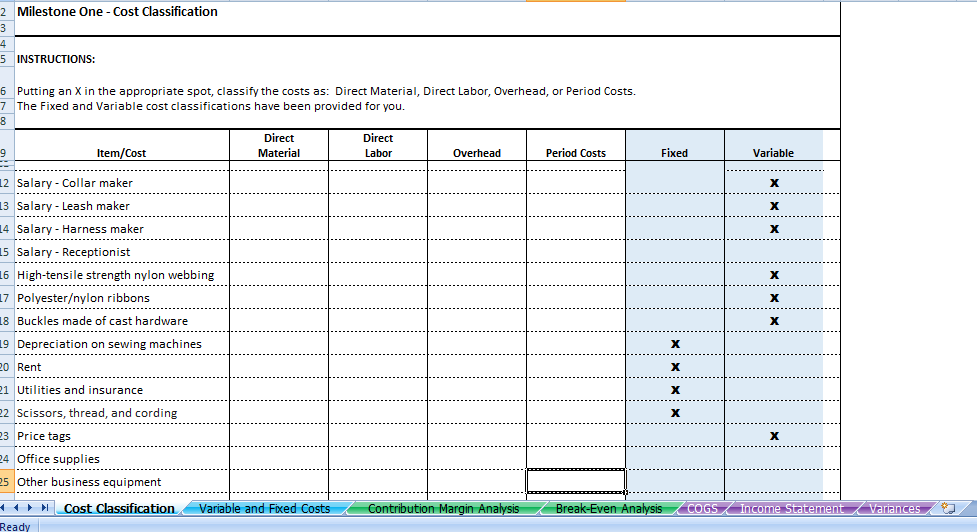

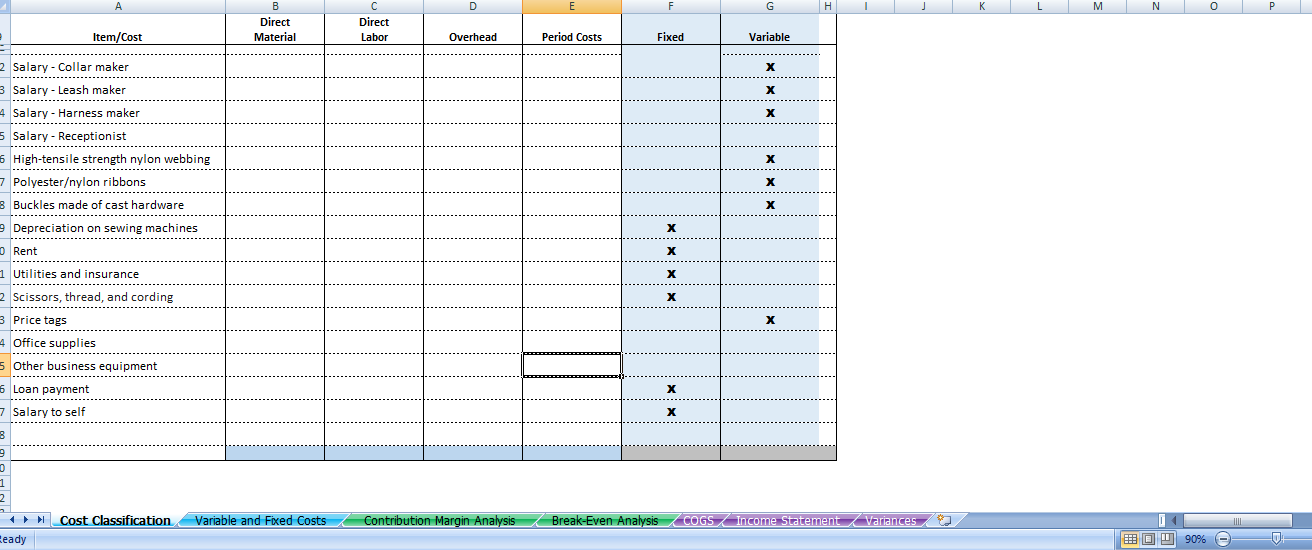

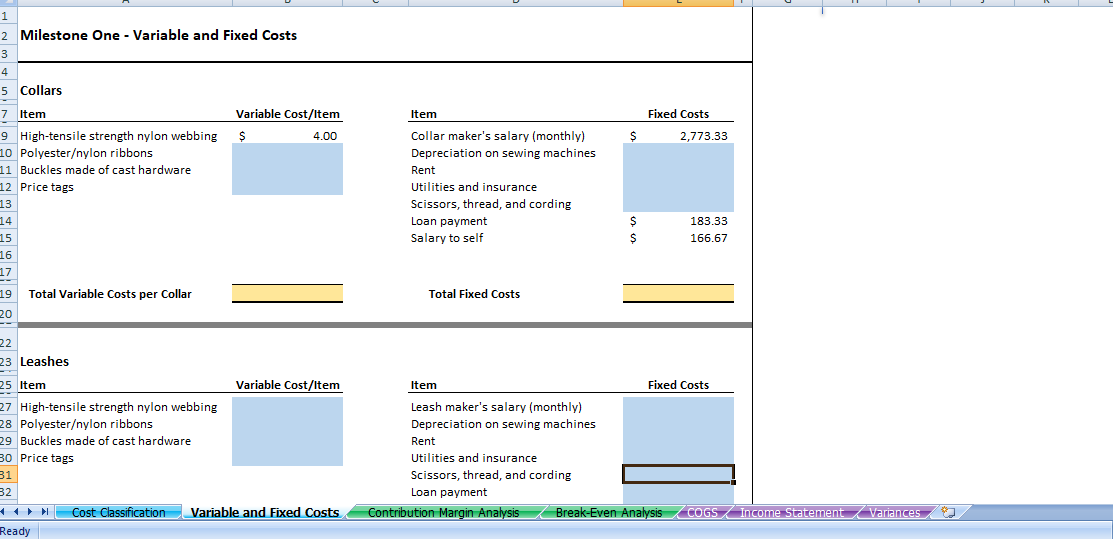

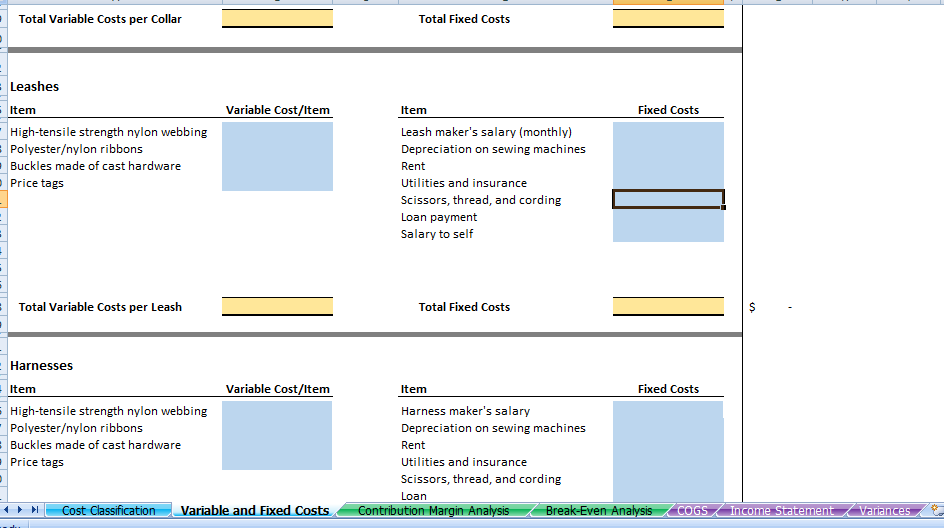

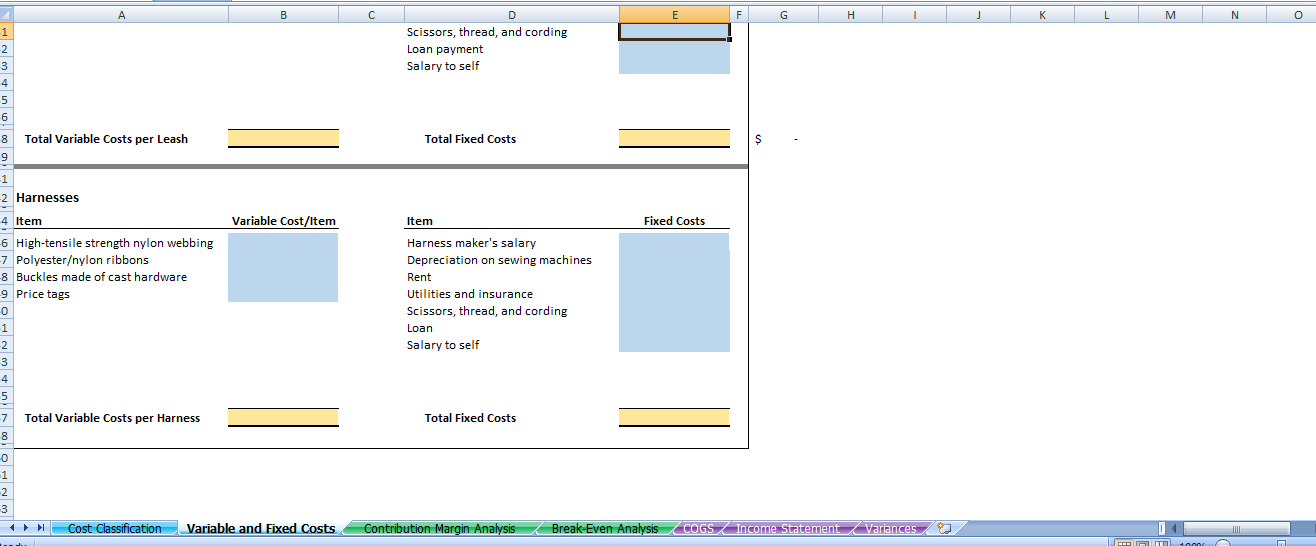

Guidelines for Submission Submit the Project Workbook with the "Cost Classification" and "Fixed and Variable Costs" tabs completed. This file should be completed and submitted using Microsoft Excel. Overview Successful entrepreneurs understand all aspects of business, especially costs and costing systems. In the course project, you will assume the role of the owner of a small business ano apply managerial accounting principles to evaluate and manage costs related to your services within a costing system. In the first milestone of the project, you will determine and classify the costs necessary for opening your business. Scenario You plan to open a business manufacturing collars, leashes, and harnesses for pets. To begin, you will manufacture these in a standard style and size with plans to expand your range over the year. In a few weeks, you will present your company's financial strategy to some key investors. To begin creating your strategy, you need to consider and record all the costs associated with operating your business. You have decided to use the job order costing system. Prompt Use the given oberational costs in the Milestone One Operational Costs Data Appendix Word Document to complete the first two tabs, "Cost Classification" and "Variable and Fixed Costs," in the Specifically, you must address the following rubric criteria: - Cost Classification. Accurately classify all your costs in the "Cost Classification" tab of your workbook. - Identify direct material, direct labor, overhead, and period costs. (Note: Fixed and variable costs have been classified for you.) - Variable and Fixed Costs. Complete the "Variable and Fixed Costs" tab of your workbook. (Note: Some costs are provided for you. Fill in only the missing costs.) - Determine your total variable cost per unit and the total fixed costs for each product. Show your work using calculations to the side of the table or using appropriate formulas in the table. 2 Milestone One - Cost Classification INSTRUCTIONS: 6 Putting an X in the appropriate spot, classify the costs as: Direct Material, Direct Labor, Overhead, or Period Costs. The Fixed and Variable cost classifications have been provided for you. 8 Total Variable Costs per Collar Total Fixed Costs Variable and Fixed costs Guidelines for Submission Submit the Project Workbook with the "Cost Classification" and "Fixed and Variable Costs" tabs completed. This file should be completed and submitted using Microsoft Excel. Overview Successful entrepreneurs understand all aspects of business, especially costs and costing systems. In the course project, you will assume the role of the owner of a small business ano apply managerial accounting principles to evaluate and manage costs related to your services within a costing system. In the first milestone of the project, you will determine and classify the costs necessary for opening your business. Scenario You plan to open a business manufacturing collars, leashes, and harnesses for pets. To begin, you will manufacture these in a standard style and size with plans to expand your range over the year. In a few weeks, you will present your company's financial strategy to some key investors. To begin creating your strategy, you need to consider and record all the costs associated with operating your business. You have decided to use the job order costing system. Prompt Use the given oberational costs in the Milestone One Operational Costs Data Appendix Word Document to complete the first two tabs, "Cost Classification" and "Variable and Fixed Costs," in the Specifically, you must address the following rubric criteria: - Cost Classification. Accurately classify all your costs in the "Cost Classification" tab of your workbook. - Identify direct material, direct labor, overhead, and period costs. (Note: Fixed and variable costs have been classified for you.) - Variable and Fixed Costs. Complete the "Variable and Fixed Costs" tab of your workbook. (Note: Some costs are provided for you. Fill in only the missing costs.) - Determine your total variable cost per unit and the total fixed costs for each product. Show your work using calculations to the side of the table or using appropriate formulas in the table. 2 Milestone One - Cost Classification INSTRUCTIONS: 6 Putting an X in the appropriate spot, classify the costs as: Direct Material, Direct Labor, Overhead, or Period Costs. The Fixed and Variable cost classifications have been provided for you. 8 Total Variable Costs per Collar Total Fixed Costs Variable and Fixed costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts